Uber (NASDAQ:UBER) has been working to secure its place at the top of the ride-sharing food chain for some time now, and all reports suggest it’s working pretty well. Uber, based on Zippia statistics, has a 71% share of the U.S. ride-sharing market as opposed to Lyft (NASDAQ:LYFT) and its 29%. Some recent moves make it clear that Uber is not resting on its laurels, and investors are all in favor.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Uber ultimately gave with one hand and took with the other. It gave its customers new features, including new video advertising in its apps as well as in its in-ride tablets. Just how the ads are presented, noted a Wall Street Journal report, will depend largely on what service is used. Those using Uber will get ads while waiting for pickup, as well as during the ride itself. Uber Eats users, meanwhile, will get ads while orders are placed. Drizly will also see ads in a similar fashion. Uber CEO Dara Khosrowshahi noted that “…the majority of our review is, to be clear, on Uber Eats,” which makes a strong case for monetization therein.

Meanwhile, Uber also took. Specifically, it took Uber Eats out of Italy and Uber entirely out of Israel. Uber Eats service faced stiff competition from several other European firms, including Great Britain’s Deliveroo, Spain’s Glovo, and the Netherlands’ Just Eat Takeaway. Meanwhile, Israel lost out on Uber entirely due to several factors, including market size, tight regulation, and, once again, strong competition in the market locally.

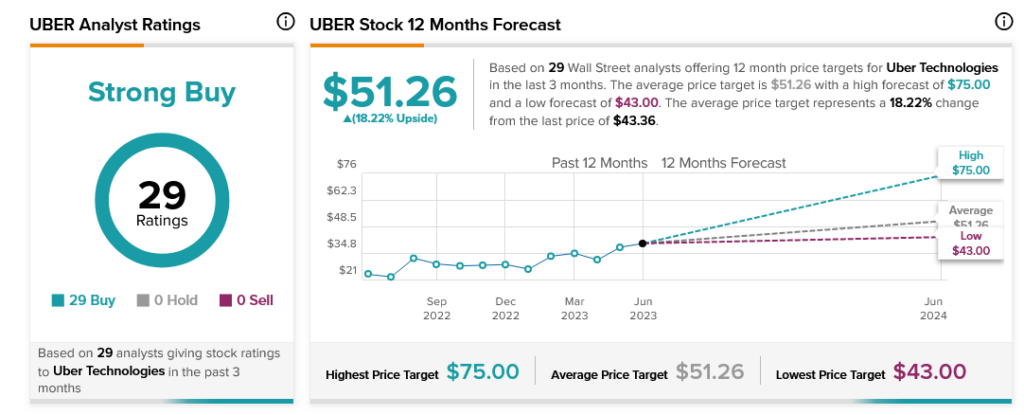

This was nowhere near problem enough to faze analysts, though. Uber stock is rated a Strong Buy by the unanimous Buy ratings of 29 different analysts. Further, Uber stock offers 18.22% upside potential thanks to its average price target of $51.26.