Shares of ride-hailing company Uber Technologies, Inc. (UBER) are up nearly 12% during the pre-market session today after the company posted robust second-quarter numbers. Notably, our website traffic tool hinted at the improvement in Uber’s major metrics.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue surged 105.3% year-over-year to $8.07 billion, outperforming estimates by $700 million. The net loss per share at $1.33, on the other hand, came in wider than consensus by $1.06. The company has delivered solid growth in key unit metrics.

Gross bookings at $29.1 billion registered a 33% year-over-growth, reaching an all-time high. During the quarter, mobility gross bookings increased by 55%, while delivery gross bookings also increased by a modest 7%. Furthermore, the company clocked about 21 million trips a day during the quarter, suggesting a 24% growth over the prior-year period.

The impact on the bottom line came primarily from headwinds associated with its equity investments in Aurora, Grab, and Zomato holdings.

Uber Management’s Comments

As market dynamics change, Uber is keeping its eyes on profits and cash flow generation. Uber CEO, Dara Khosrowshahi, commented, “Last quarter I challenged our team to meet our profitability commitments even faster than planned-and they delivered. Importantly, they delivered balanced growth.”

Uber CFO, Nelson Chai, added, “We became a free cash flow generator in Q2, as we continued to scale our asset-light platform, and we will continue to build on that momentum. This marks a new phase for Uber, self-funding future growth with disciplined capital allocation while maximizing long-term returns for shareholders.”

Looking ahead to Q3, the company expects gross bookings to range between $29 billion and $30 billion. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) are expected to be between $440 million and $470 million.

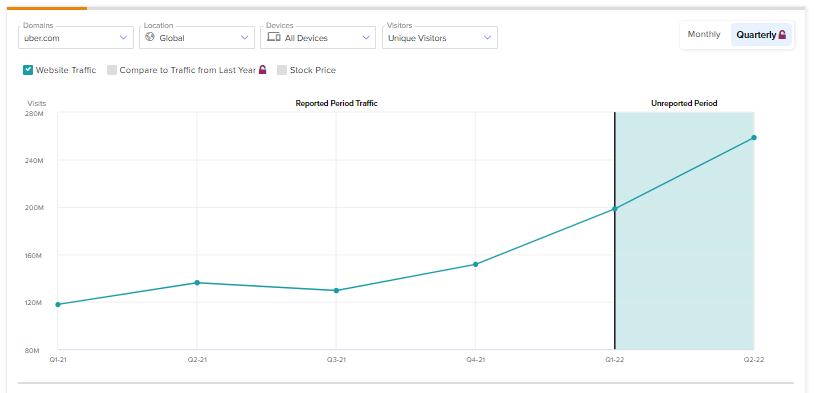

UBER Website Traffic

Impressively, our website traffic tool could have helped investors get a glimpse of these results. Data shows that total website traffic for Uber globally and across devices has been ticking upwards since Q3 2021. Additionally, during Q2, these visits jumped nearly 30.3% as compared to the prior quarter.

Learn how Website Traffic can help you research your favorite stocks.

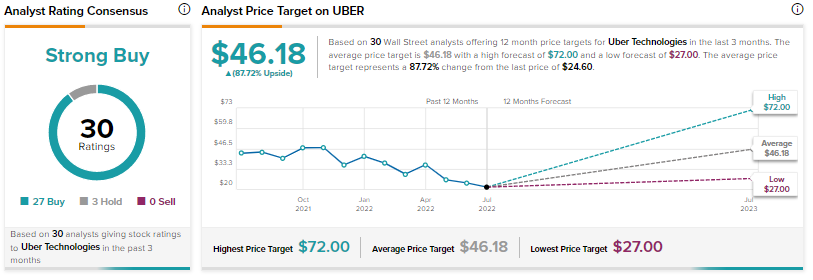

Analysts’ Take on Uber

The Street, in the meantime, has a Strong Buy consensus rating on the stock alongside a price target of $46.18, implying an 87.72% potential upside. That’s after a 44% slide in share prices so far in 2022.

Closing Note

Uber has driven in a resounding second-quarter performance that should shore up investor sentiment in the stock. Additionally, as funding dries up globally, a focus on self-funded growth and cash flow generation bodes well for the company over the coming periods.

Read the full Disclosure