Shares in Uber Technologies Inc. (UBER) rose 6.3% after the ride-hailing company announced a second round of job cuts in a move to help cut costs by $1 billion annually and cope with the economic hardships resulting from the coronavirus pandemic.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The stock appreciated 6.3% to $34.52 in early afternoon trading as the company said it will need to cut another 3,000 jobs following the first round of 3,700 layoffs announced earlier this month. Uber expects to incur $175 million to $220 million in severance and benefits charges due to the job cuts.

“Given the dramatic impact of the pandemic, and the unpredictable nature of any eventual recovery, we are concentrating our efforts on our core mobility and delivery platforms and resizing our company to match the realities of our business,” Uber CEO Dara Khosrowshahi said in a SEC filing. “We are making these hard choices now so that we can move forward and begin to build again with confidence.”

In addition, Uber plans to close 45 of its offices for which it expects to incur $65 million to $80 million in charges, including about $25 million to $30 million for write-offs. The charges are primarily cash-based, and the majority are expected to be recognized in the second quarter of 2020, the company said. Furthermore, Uber said that all members of the company’s Board of Directors agreed to forego 100% of their annual cash retainer for the remainder of 2020.

Uber has been focusing on ramping up its food delivery business as the demand for the service has been offsetting weak rides demand during the coronavirus pandemic. As part of the effort, Uber is reportedly in advanced talks to purchase rival food delivery company GrubHub Inc. (GRUB).

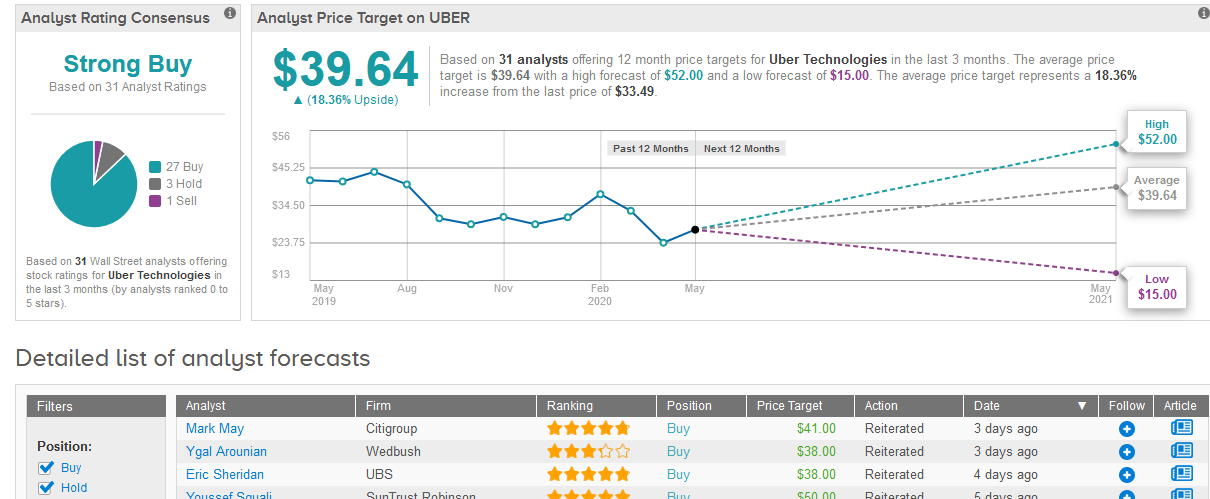

Overall, Wall Street analysts have a bullish outlook on Uber’s stock boasting 27 Buys, 3 Holds and 1 Sell that add up to a Strong Buy consensus. The $39.64 average price target implies shares have room to advance 18% in the coming 12 months. (See Uber’s stock analysis on TipRanks).

Related News:

Uber’s Latest Takeover Offer Said To be Rejected By GrubHub

Uber Announces $750M Notes Offering, As GrubHub Takeover Reports Swirl

Uber Puts Hopes on Food Delivery Momentum After $2.9 Billion Loss