Uber (NYSE:UBER), a ride-hailing service company, trended lower in pre-market trading after announcing a convertible senior notes offering of $1.2 billion due in 2028. According to Uber’s press release, the notes are being offered only to qualified institutional buyers. Uber also intends to grant the initial buyers of the notes an “option to purchase, within a 13-day period beginning on, and including, the date on which the notes are first issued, up to an additional $180.0 million aggregate principal amount of the notes.”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company intends to use a portion of the net proceeds from the offering to fund the cost of entering into capped call transactions. The remainder of the net proceeds are intended to be used to repay, redeem, or repurchase outstanding debt, including the outstanding $1 billion aggregate principal amount of Uber’s 7.5% senior notes due in 2025.

In connection with the pricing of the notes, Uber expects to enter into privately negotiated capped call transactions with one or more of the initial buyers of the notes. The capped calls will help to limit (cap) the amount by which the company’s stock can be diluted if the convertible notes are turned into stock.

Is Uber a Buy or Hold?

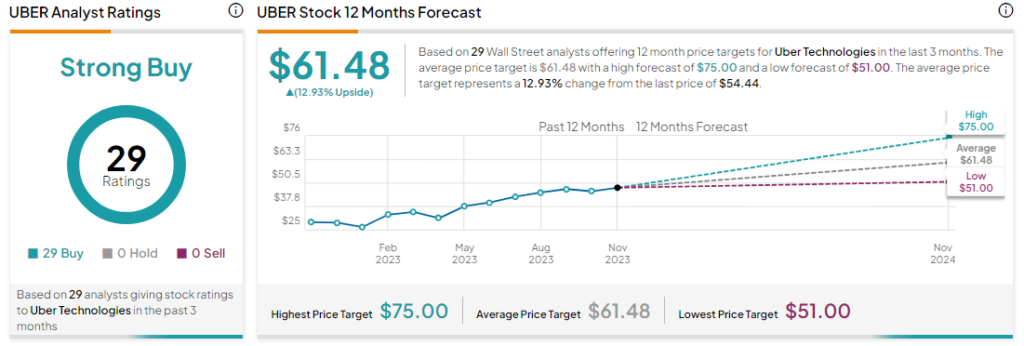

Analysts are bullish about UBER stock, with a Strong Buy consensus rating based on 29 buys. Even as UBER stock has soared by more than 100% year-to-date, the average price target of $61.48 implies an upside potential of 12.9% at current levels.