Uber Technologies, Inc. (UBER) and bp (BP) have entered into a new strategic convenience delivery partnership with a view to meet the growing demand for essentials to be delivered at door.

Uber offers a ride-hailing service, food order and delivery, along with a freight transportation business, while bp is a vertically integrated energy company operating in all areas of the oil and gas industry.

Bp and Uber Eats seek to have more than 3,000 retail locations operational on the platform by 2025.

Under this extended agreement, stores are likely to be opened in Australia, New Zealand, Poland, South Africa and parts of the U.S. Other European locations will be added later on.

Executive Comments

“We’re thrilled to team up with Uber Eats globally giving us the opportunity to reach many more consumers online in addition to those who currently visit our retail sites… And for the first time, we will be able to offer delivery options to existing customers on our own BPme app by the end of 2023,” said Emma Delaney, executive vice president customers & products at bp.

Uber’s SVP of Global Delivery, Pierre Dimitri Gore-Coty, said, “With more than 20,500 locations around the world, bp’s reach is enormous—making them critical partners as we pursue our ambitions of helping consumers across the world get what they need delivered to their doorsteps.”

Analyst Recommendations

Last week, Evercore ISI analyst Mark Mahaney reiterated a Buy rating on Uber with a price target of $77.

Mahaney said, “We find Uber’s announcement of implementing 100% of NYC taxis onto its platform via CMT/Curb this Spring as potentially a ~$1.4B Gross Bookings opportunity. …and marks a major first step in achieving its goal to have every taxi in the world on the Uber platform by 2025.”

Consensus among analysts is a Strong Buy based on 25 Buys and one Sell. The average Uber price target stands at $60.48 and implies upside potential of about 64% to levels observed at 10:41am EST., Tuesday.

Website Traffic

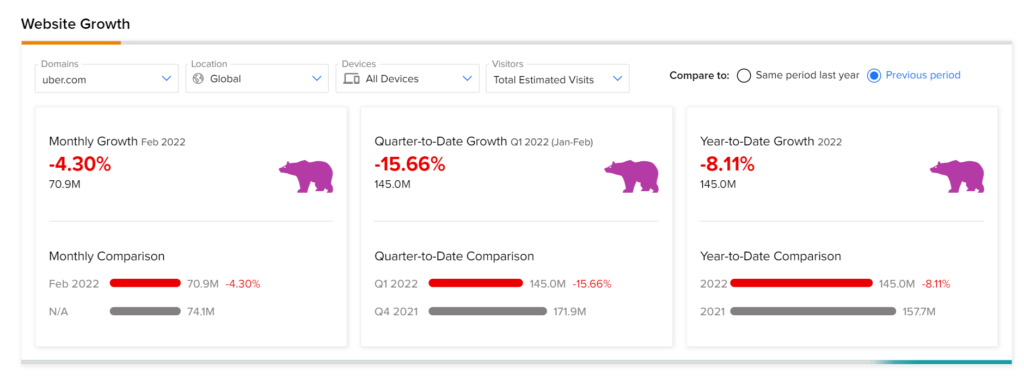

TipRanks’ Website Traffic tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into UBER’s performance.

According to the tool, in February, uber.com recorded a 4.3% monthly decrease in global visits compared to the previous year. Likewise, year-to-date website traffic growth has declined 8.1%, against the same period last year.

Takeaway

The deal seems to be promising for both the companies and might boost shares of both companies. Bp is expected to benefit from Uber’s well established drivers’ and orders dispatch system, whereas Uber will reap benefit from bp’s experience in convenience delivery business.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Victoria’s Secret Rises 3.2% on Securing Minority Stake in Frankies Bikinis

Exela’s Strategic Investment in UBERDOC to Expand its Digital Healthcare Footprint

Axsome Rises 2.1% on Acquisition of Sunosi from Jazz Pharmaceuticals