The U.S. government has signed a new $80 billion nuclear energy deal with Brookfield Asset Management (BAM) and Cameco (CCJ), partners in the nuclear reactors powered by Westinghouse Electric.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The U.S. Commerce Department said that it will arrange financing and facilitate approvals for at least $80 billion in nuclear energy from Westinghouse, which is 51%-owned by Brookfield and 49%-owned by Cameco. Both companies’ stocks are up on news of the government deal.

Analysts were quick to say that the U.S. government’s investment will help to break a logjam that has kept America from building new nuclear power plants for several decades. Only three new reactors have been built in the U.S. this century. Utilities have been reluctant to build nuclear reactors because of the expense involved.

Massive Investment

JPMorgan Chase (JPM) estimates that the $80 billion investment could finance as many as eight large-scale nuclear reactors in the U.S. The bank adds that the government investment could generate cash for a long time. “Each reactor built will require decades of fuel and maintenance services, securing high-margin, recurring revenue streams for Westinghouse and its owners,” wrote JPMorgan in a note to clients.

As part of the deal, the government will receive 20% of any cash distributions over $17.5 billion made by Westinghouse once the $80 billion investment is reached. In most other countries, governments take a more direct stake in building nuclear power plants, usually through state-controlled companies. China is currently building dozens of nuclear reactors with state support.

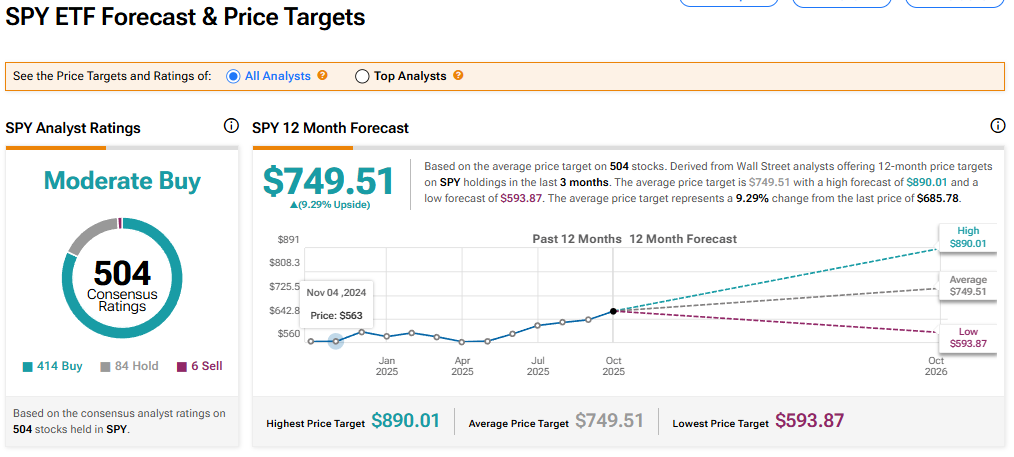

Is the SPDR S&P 500 ETF Trust a Buy?

The SPDR S&P 500 ETF Trust (SPY) currently has a Moderate Buy rating among 504 Wall Street analysts. That rating is based on 414 Buy, 84 Hold, and six Sell recommendations issued in the last three months. The average SPY price target of $749.51 implies 9.29% upside from current levels.