The U.S. government just gave a wider range of tech firms the green light to dip into the cash pot known as the CHIPs Act. Now, not only major players like Intel (NASDAQ: INTC) and Taiwan Semiconductor (NASDAQ: TSM) but also companies that craft the tools and chemicals for chip-making, such as Applied Materials (NASDAQ: AMAT) and Lam Research (NASDAQ: LRCX), can get a piece of the action. The Commerce Department said that nearly 400 firms are eyeing these funds with interest.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The CHIPs Act provides a whopping $52.7 billion dedicated to recharging America’s semiconductor industry, $39 billion of which is set aside specifically for manufacturing incentives. This move was a response to some serious supply chain hiccups caused by the pandemic, and it’s already driving billions in private-sector investments. Taiwan Semiconductor, one of the industry’s heavy hitters, has been working the global network to build up its Arizona base, despite having a few reservations about some aspects of the legislation.

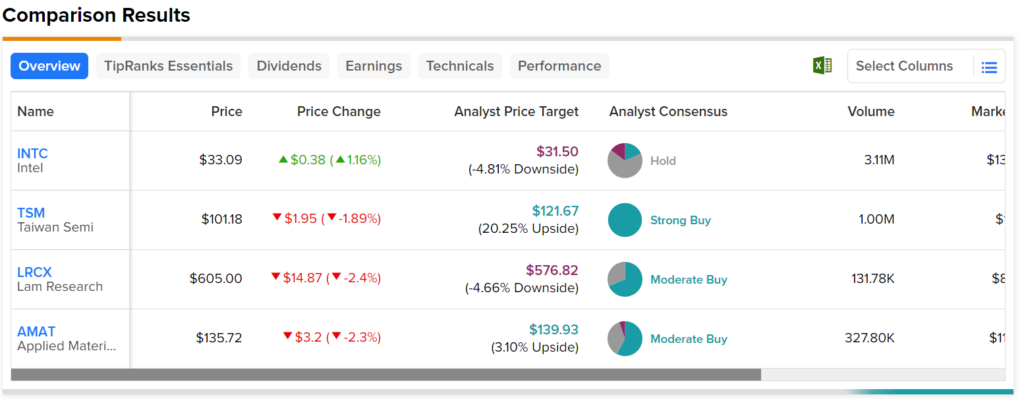

Despite today’s news, the aforementioned chip stocks are mostly trading lower in today’s session. Indeed, only INTC stock is green at the time of writing. Nevertheless, out of these four stocks, it appears that Wall Street expects the most out of TSM stock, as it’s rated a Strong Buy with over 20% upside potential.