Shares of Texas Instruments (NASDAQ:TXN) slipped in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2023. Earnings per share came in at $1.85, which beat analysts’ consensus estimate of $1.77 per share. Sales decreased by 10.8% year-over-year, with revenue hitting $4.38 billion. This beat analysts’ expectations of $4.37 billion.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Management offered up some future projections for Texas Instruments’ second quarter. Earnings per share are expected to be between $1.62 and $1.88 per share compared to the $1.87 consensus. Further, revenue is expected between $4.17 billion and $4.53 billion against the $4.46 billion consensus.

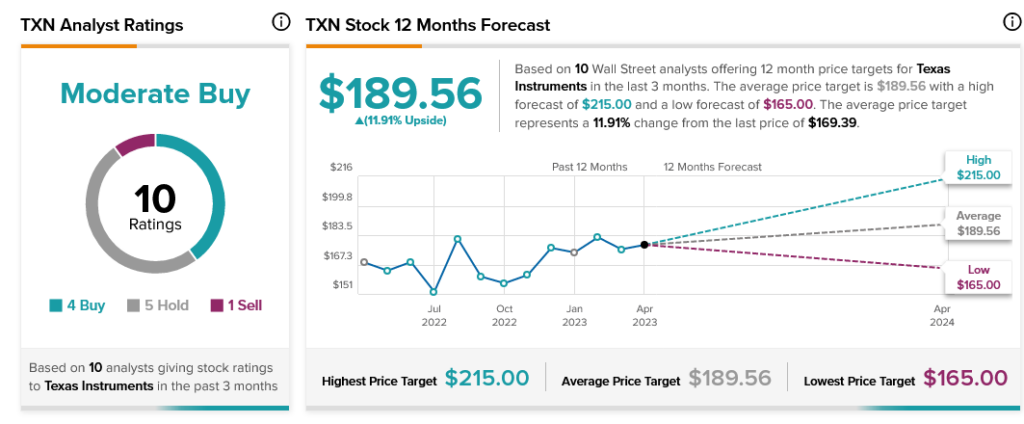

Overall, Wall Street has a consensus price target of $189.56 on Texas Instruments, implying 11.91% upside potential, as indicated by the graphic above.