There were some doubts about demand for PCs going into 2024. Their sheer necessity these days clashed with a comparative lack of resources available to purchase them. Meanwhile, Wedbush analysts found the time was ripe for not only PC demand to come back but also for two major chip stocks to benefit from the trend. Intel (NASDAQ:INTC) and AMD (NASDAQ:AMD), longtime rivals in the field, were both cited to benefit. And both were up fractionally in Tuesday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Word from Wedbush Securities, via analyst Matt Bryson, noted that PC shipments were indeed down in the fourth quarter in aggregate. However, Bryson doesn’t expect that to become a trend and noted that “…standard server requirements will normalize in the coming quarter creating upside to server demand beyond the mid single-digit growth anticipated by industry analysts.” The biggest reason for Bryson’s optimism is the “replacement cycle” of hardware bought back during the pandemic almost four years ago, which is likely starting to show its age accordingly. Bryson, therefore, hiked price targets on both stocks, raising Intel from $35 to $45 and AMD from $130 to $200.

Bryson is Not Alone Here

Interestingly, Bryson isn’t alone in his projections. Acer CEO and chairman Jason Chen noted that PC demand is making a comeback. Demand bottomed out back in May, and ever since, demand has started piling up at Acer. It may only be the fifth-largest PC maker, but if it’s seeing a rise, it’s safe to say that other PC makers are either seeing it now or about to see it soon. All PCs eventually need to be replaced at some point, and though both consumer and corporate spending have been curtailed in light of current conditions, the replacement can only be delayed for so long.

Which Chip Stocks are a Good Buy Right Now?

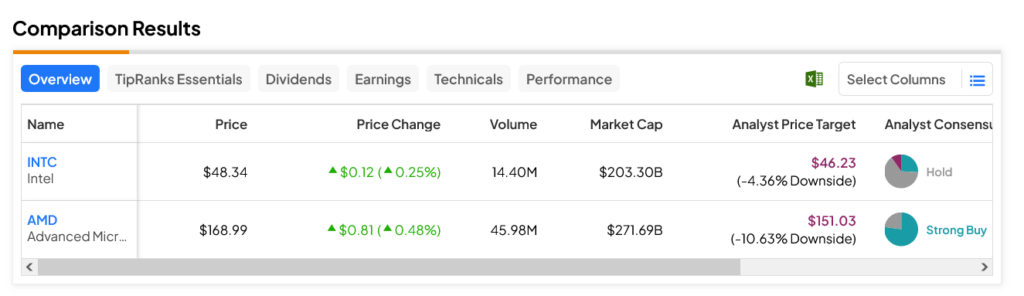

Turning to Wall Street, INTC stock is actually the leader among the two, with a 4.36% downside risk on its $46.23 average price target. AMD stock, meanwhile, is the laggard with a 10.63% downside risk against its $151.03 average price target.