The banks financing the Twitter (NYSE:TWTR) Musk deal are staring at a potential loss of about $500 million, Bloomberg reported.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Per the report, Morgan Stanley (NYSE:MS), Bank of America Corp NYSE:BAC), Barclays Plc (NYSE:BCS), and Mitsubishi UFJ (NYSE:MUFG) committed $13 billion in debt financing for the deal. However, as interest rates have risen on the back of the Fed’s hawkish stance, these banks will bleed money for financing the deal at lower yields.

Further, the Bloomberg report highlighted that out of the $500 million estimated loss, $400 million is related to the risky unsecured bonds, which have a higher interest rate of 11.75%.

All this means that banks financing the deal will find it hard to sell the debt.

Last week, a Delaware judge presiding over the Twitter acquisition case agreed to Musk’s request to delay the trial set for October 17 to October 28.

Wall Street’s Take on Twitter Stock

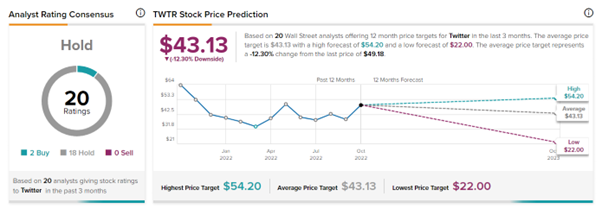

As per TipRanks, Twitter’s average price target of $43.13 implies 12.30% downside risk from current levels. The highest price target is set at $54.20 (10.2% upside potential), while the lowest price target of $22 implies a 55.3% downside risk.

Given the uncertainty facing the Elon Musk deal, TWTR stock has received two BuyS and 18 Hold recommendations, for a Hold consensus rating.

Further, TWTR stock has a very negative signal from hedge fund managers, who sold 3.1 million shares last quarter.