Shares of communications software developer Twilio (NYSE:TWLO) rallied more than 7% in Wednesday’s extended trading session after the company reported market-crushing third-quarter earnings and Q4 outlook. Also, the company raised its full-year adjusted operating income guidance to reflect solid year-to-date results.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Twilio’s Q3 Performance

Twilio’s Q3 revenue grew 5% year-over-year to $1.03 billion, driven by a 5% rise in the Communications business and a 9% increase in the Data and Applications segment’s revenue. The company swung to adjusted earnings per share (EPS) of $0.58 from a loss per share of $0.27 in the prior-year quarter. Analysts expected adjusted EPS of $0.37 on revenue of $990 million. On the earnings call, management said that the company continued to see stabilization in volumes across its usage-based offerings throughout the third quarter.

Twilio’s efforts to drive growth with a more efficient cost structure fueled the solid performance in the third quarter. The company divested its IoT business in June 2023 and ValueFirst business in July to sharpen its focus on profitable areas.

Solid Guidance

Twilio issued better-than-projected guidance for the fourth quarter even as it acknowledged that some customers are experiencing a slowdown due to the ongoing macro challenges. The company expects Q4 2023 revenue to grow in the range of 1% to 2%. It projects Q4 adjusted EPS between $0.53 and $0.57, way ahead of analysts’ consensus estimate of $0.39.

Also, the company’s year-to-date performance helped raise the full-year outlook for adjusted income from operations to $475 million to $485 million from the previous guidance of $350 million to $400 million.

Is Twilio a Buy or Sell?

Today, TD Cowen analyst Derrick Wood acknowledged Twilio’s Q3 beat on revenue and operating margin but reiterated a Hold rating on the stock with a $60 price target, saying that core key performance indicators (KPIs) remain under pressure. In particular, he noted that the net retention rate (NRR) continued to decline, falling to 101% from 103% in Q2 2023 and 122% in the prior-year quarter.

The five-star analyst also noted that the new customer count of about 2,000 hit a new low compared to nearly 4,000 in Q2 2023 and about 5,000 in Q3 2022.

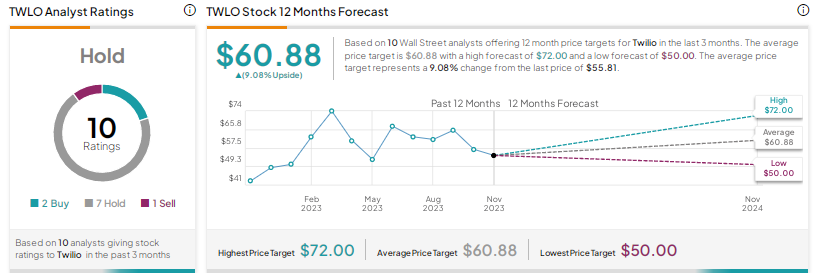

Overall, Wall Street is sidelined on TWLO stock, with a Hold consensus rating based on two Buys, seven Holds, and one Sell. The average price target of $60.88 implies 9.1% upside potential.