Earlier this year, we saw the debut of two ETFs that allowed investors to tap into and try and make the most out of insights from Jim Cramer, one of the most visible faces in the world of finance for a number of years. Now, one of these ETFs is going the way of the dodo, according to a report by Benzinga.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

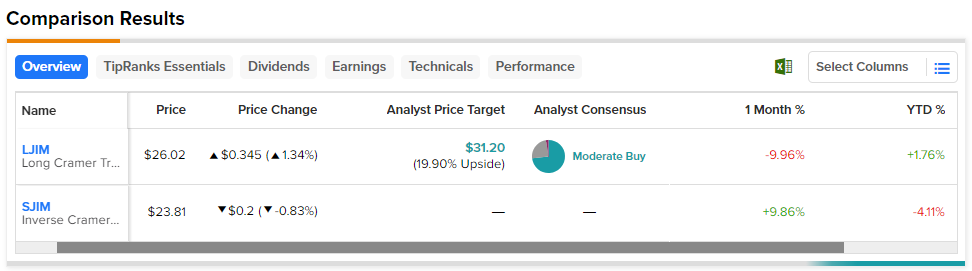

The Cramer-themed ETFs were introduced by Tuttle Capital, and investors could ride on his long recommendations via the Long Cramer Tracker ETF (BATS:LJIM), or bet against the recommendations via the Inverse Cramer Tracker ETF (BATS:SJIM).

Now, LJIM will be shut down and cease trading on September 11th. The fund’s assets will be distributed back to its investors.

Interestingly, both Cramer and CNBC largely ignored these funds. Tuttle Capital, which wanted to only introduce SJIM but created LJIM only “to be nice,” does not see any reason to keep LJIM going. Its CEO and CIO, Matthew Tuttle, commented to Benzinga, “So we all know Jim’s stock picks have been suspect, to say the least.”

Cramer, though, remains as energetic as ever. After the filings for the two ETFs last year, the Mad Money host had commented, “I want you to bet against me.”

While LJIM has dropped nearly 10% over the past month, SJIM has popped 9.9%. meanwhile, Tuttle has more themed ETFs planned for the future and is looking to file for one this week.

Read full Disclosure