Layoffs are generally bad news for those on the receiving end. Adding the phrase “just before Christmas” only deepens the blow. For TuSimple Holdings (NASDAQ:TSP), that’s just what happened. The market isn’t taking this Dickensian maneuver well, either; TuSimple is down significantly in Thursday afternoon trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The latest casualty reports note that TuSimple is cutting roughly 25% of its workforce, a loss of about 350 people that will bring TuSimple’s total employee count down to about 1,100 when it’s all finished. The move will save the company a shocking $55 million to $65 million annually. TuSimple took the step to conserve capital and is part of a string of recent moves designed to help keep the company going.

There is some uncertainty, however, over where the cuts will hit. TuSimple has operations in three locations in the United States—Arizona, San Diego, and Texas—as well as Europe and China. Reports note that TuSimple has yet to file Worker Adjustment and Retraining Notification (WARN) Act paperwork, so the layoffs may be focused elsewhere.

However, this is not as bad as it might have been; reports noted that the company was previously planning to lose as many as 700 workers. Operations in Arizona may be the first to go; the company suffered a bizarre accident with one of its self-driving trucks therein. For little discernible reason, the truck abruptly turned left while on I-10, slamming into a concrete barrier.

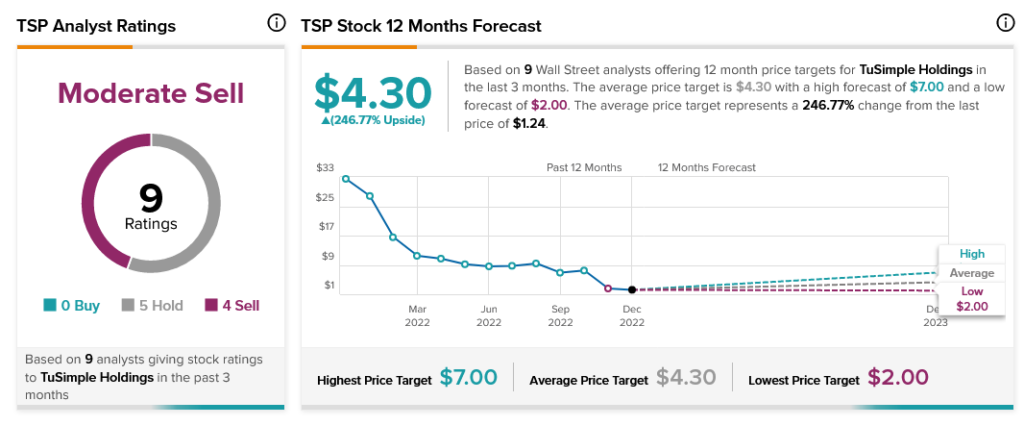

It’s unclear whether this will improve TuSimple’s stance with analysts. Analyst consensus calls TuSimple a Moderate Sell, with just one more Hold recommendation than Sells and no Buy recommendations. Nevertheless, TuSimple’s average price target of $4.30 gives it an upside potential of 246.77%