Gaming accessory industry player Turtle Beach (NASDAQ:HEAR) may have turned the corner from a decline in its share price (down more than 44% in the past three years) following a post-COVID lockdown revenue drop. The stock has risen nearly 41% year-to-date. The company is preparing for a leap forward in 2024 with a new CEO and a promising acquisition. The shares are currently relatively undervalued, but may not stay that way long.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sounding Good

Turtle Beach is a player in the gaming accessory landscape, focusing on the development, commercialization, and marketing of high-quality audio peripherals. The company dominates the gaming headset market with roughly 40% market share and is the leading console gaming headset provider to both the Xbox and PlayStation markets.

The company was a beneficiary of a dramatic spike in demand related to the COVID lockdown, as work-from-home helped drive an increase in its revenues by over $100 million in 2020 and 2021 relative to pre-pandemic levels. Post lockdown, however, revenues look to have mean-reverted, causing the share price to decline significantly in the past three years and ushering the CEO out the door in Q2 2023.

After an exhaustive executive search process, Turtle Beach recently announced the appointment of Cris Keirn as CEO and Board Member. Keirn’s journey with Turtle Beach started in 2013, and his contributions to the successful transformation of the company’s product range in his role as Vice President of Business Planning and Strategy weighed heavily in his favor in obtaining the post.

Recent Results and the Road Ahead

Despite falling short of the Q4 consensus with a revenue of $99.5 million (consensus $111.6 million) and an EPS of $0.47 (consensus $0.60), Turtle Beach exhibited positive growth in 2023. The company’s annual revenue came in at $258.1 million, marking a 7.5% increase from the previous year, with a gross margin of 29.3% compared to 20.5% in 2022.

Turtle Beach is forecasting a bullish FY24 with a substantial increase in revenue between $370 million and $380 million. Also, the company expects adjusted EBITDA to spike significantly from $6.5 million in FY23 to $51 million-$54 million in FY24.

The integration of Performance Designed Products (PDP), a recent acquisition, is anticipated to drive the revenue jump in 2024. The acquisition bolsters Turtle Beach’s scale and growth potential, adding PDP’s leading gaming controller segment to its portfolio.

Where HEAR Stock Stands Now

Over the last 90 days, HEAR stock has risen over 37%, with the lion’s share coming in the aftermath of the PDP acquisition announcement. HEAR is trading at the top of its 52-week range of $7.45-$15.77. It shows ongoing positive price momentum, trading above the 20-day (11.62) and 50-day (11.27) moving averages.

Despite the recent price run-up, the stock still trades in undervalued territory. Its price-to-sales ratio of 1.03x is below the Technology sector average of 4.65x and the Consumer Electronics industry average of 3.68x.

Is HEAR a Buy, Hold, or Sell?

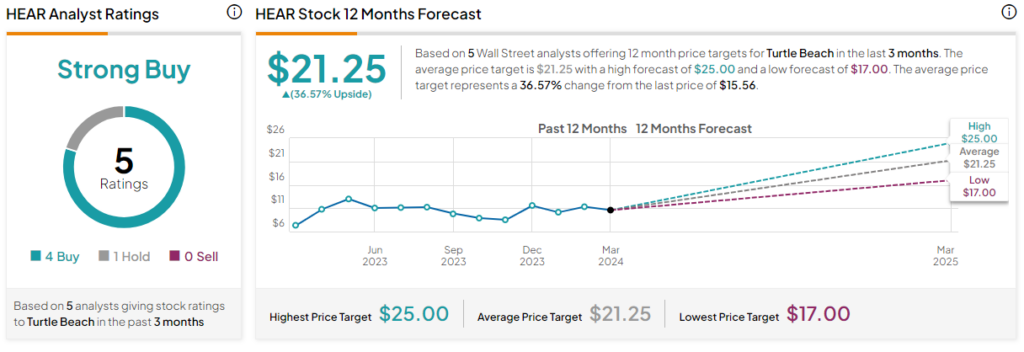

Analysts covering HEAR stock have been bullish, especially after the announced acquisition, and most have raised their price targets. For example, Roth MKM analyst Sean McGowan raised the firm’s price target to $25 from $17 and kept a Buy rating on the shares, citing a “transformational acquisition” that could result in significantly higher revenue and EBITDA.

HEAR is currently listed as a Strong Buy based on four Buys and one Hold rating in the past three months. The average Turtle Beach price target of $21.25 represents an upside potential of 36.57% from current levels.

Closing Thoughts

Post-pandemic, Turtle Beach struggled with falling revenue, which prompted a change in leadership. The company has managed to bounce back with an expected substantial increase in revenue in FY24, driven by the integration of the recently acquired Performance Designed Products.

HEAR stock has risen significantly recently, though comparative metrics suggest it is still undervalued. Furthermore, the company’s decision to buy back $30 million of its stock through a reverse “Dutch Auction” this spring could serve as an additional boost to shareholders over time. This might be a prime entry point for long-term value investors who are considering adding Turtle Beach to their portfolio.