The options market for options on American Airlines (AAL) stock has been turbulent as the airline presents a mixed picture of corporate health. Essentially, the embattled carrier presents a tale of two halves, with sharply contrasting performance between the first and second halves of 2025. In the first six months of the year, AAL stock fell by roughly 34%. The red ink stemmed from financial challenges and a generally unfavorable perception among consumers. However, since June, AAL has been on a strong run, gaining approximately 24%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Furthermore, AAL stock saw a more than 4% surge last week after investors digested the company’s announcement that it plans to cut “hundreds” of jobs, thereby affecting both mid-management and support staff positions.

While investors eventually cheered the implications of streamlined operations, it also raises an important question: Is AAL stock an opportunity for the bulls, or has the good news been fully priced into the equity? To answer that, we’ll need to utilize probabilistic thinking.

Using Baseball to Help Fully Absorb the Financial Red Pill

In the sport of baseball, the shortstop represents one of the most demanding defensive positions, primarily because most batters are right-handed and tend to pull the ball. That means more balls are going to be put into play in the shortstop’s area of responsibility. Furthermore, at the elite level, teams utilize extensive analytics to gain a deeper understanding of their opponents’ tendencies.

So, if sports participants place this much emphasis on data and analytics, why wouldn’t that same rigor apply to the stock market? One would think so, and yet, it remains a common sight to see investors splashing thousands of dollars on investments without conducting any statistical or quantitative analysis at all.

At best, investors utilize technical and fundamental analysis to speculate on future price movements, even though both forms of analysis are not rigorous and cannot be applied consistently.

For options traders, an empirical model is required. One way to do this is to treat price changes as measurable events that can be analyzed in terms of probability and outcomes. In practical terms, this means approaching the stock market the way a shortstop approaches the field — by using probability-based calculations to anticipate where the next move will occur.

Of course, just like in sports, there are no guarantees. Unexpected events can always happen. However, by applying data science and probability models, traders can more effectively manage risk and reduce the likelihood of significant losses.

Leveraging Data Science to Formulate an AAL Trade

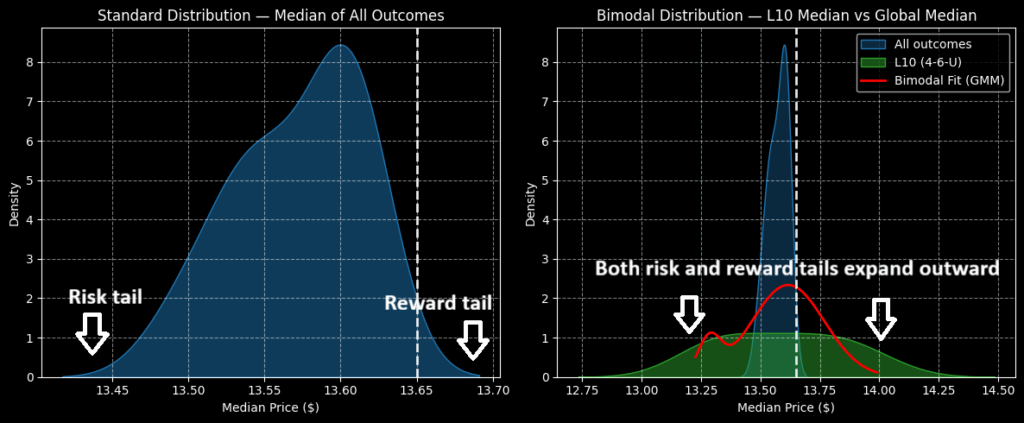

Using the aforementioned axioms, the forward 10-week median returns of AAL stock can be arranged as a distributive curve, with outcomes ranging between $13.42 and $13.68 (assuming an anchor price of $13.65). Further, price clustering — the area where the struck balls are most likely to land, to extend the baseball analogy — would likely occur at $13.60.

Now, the above distribution is based on baseline or homeostatic conditions. However, we know through GARCH (Generalized Autoregressive Conditional Heteroskedasticity) studies that volatility diffuses as a clustered, non-linear phenomenon. By logical inference, we can deduce that different market stimuli elicit distinct market behaviors. This is the essence of Newtonian mechanics, and it also applies to the financial markets.

Currently, the quantitative signal of AAL stock is structured in a rare 4-6-U formation, meaning that over the past 10 weeks, AAL has experienced four up weeks and six down weeks, but with an overall upward trend. Under this condition, forward 10-week returns would be expected to range between $12.75 and $14.50. Most importantly, price clustering would likely be predominant between $13.35 and $13.75.

Unfortunately, if the 4-6-U signal’s strength holds true, it doesn’t provide traders with the clearest look. However, for most of the next six weeks, the exceedance ratio — or the likelihood of AAL stock being profitable relative to the anchor — should be above 50%. In the fifth and sixth weeks, the exceedance ratios may be 64% and 60%, respectively.

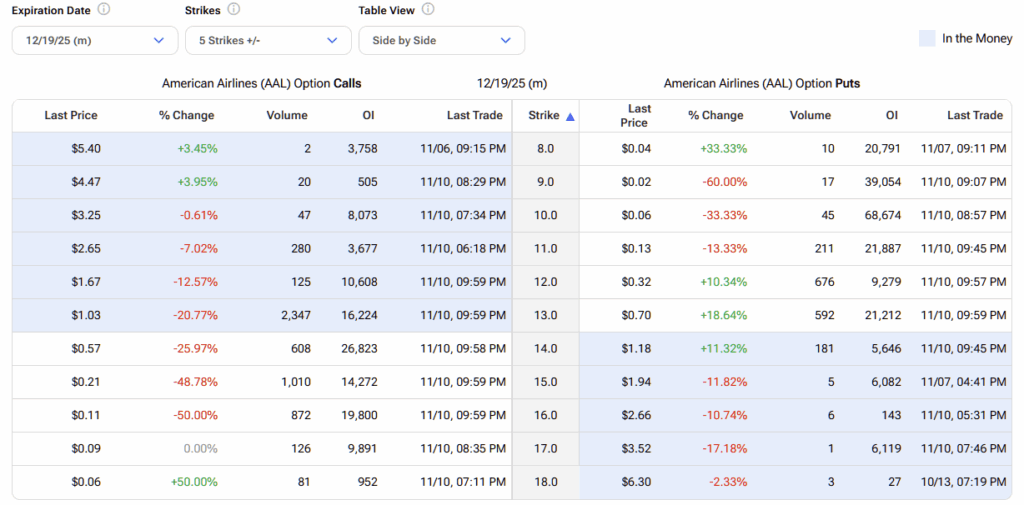

As such, I believe the 13/14 bull call spread, expiring on December 19, is probably the most aggressive trade speculators should consider. This transaction involves buying the $13 call and simultaneously selling the $14 call, for a net debit paid of $56 (the maximum possible loss). If AAL stock rises through the second-leg strike of $14 at expiration, the maximum profit would be $44, a payout of roughly 79%.

Granted, there are more exotic ideas available, like the 14/15 bull spread expiring December 19, which carries a max payout of over 156%. However, the problem here is that, based on price clustering dynamics, the more realistic proposition is the 13/14 spread.

What is the Price Target for AAL?

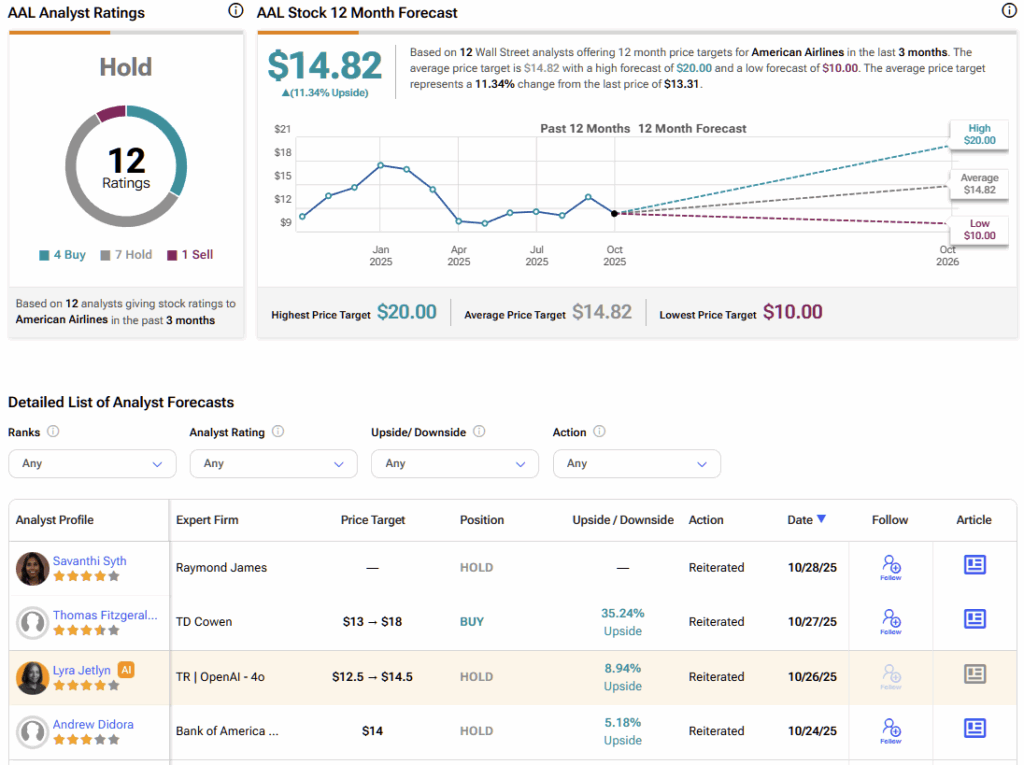

Turning to Wall Street, AAL stock has a Hold consensus rating based on four Buys, seven Holds, and one Sell rating. The average AAL price target is $14.82, implying 8.57% upside potential over the next 12 months.

Applying Data-Driven Thinking to Volatile Stocks like AAL

It’s remarkable that a sport designed purely for entertainment has embraced advanced analytics more deeply than many traders or even segments of the financial media that claim to focus on sound investing. In professional sports, every play, tendency, and outcome is meticulously measured, modeled, and optimized to enhance performance. Yet in the stock market—where real money and livelihoods are at stake—many participants still rely on gut feelings, headlines, or surface-level analysis.

Fortunately, the same analytical principles first explored in behavioral research can be applied to investing. By adopting a data-driven approach rooted in probability and observation, traders can better navigate uncertainty and make more informed decisions—even with volatile stocks like American Airlines.