Tufin Software Technologies Ltd. (TUFN), a security policy management company, delivered better-than-expected second-quarter results driven by year-over-year revenue growth. Shares soared 10.8% on the news and closed at $10.97 on August 11.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company reported a quarterly loss of $0.22 per share, narrower than the Street’s estimated loss of $0.31 per share. Tufin recorded a loss of $0.15 per share in the year-ago period.

Additionally, revenue grew 12% to $25.74 million, higher than analysts’ estimates of $23.14 million.

Product revenue and Maintenance and Professional Services revenue grew 23% and 6% year-over-year, respectively, showing continued momentum for its business offerings. (See Tufin Software Technologies stock charts on TipRanks)

Moreover, during the quarter, the company increased its security policy management capabilities with the announcement of the Tufin Orchestration Suite R21-2. Tufin also announced a new Marketplace app called the Rule Lifecycle Management (RLM), which simplifies and manages the rules review and certification process.

Commenting on the results, Ruvi Kitov, the company’s CEO and Co-Founder said, “Early indications give us confidence in our strategic direction and the effectiveness of our transformation. We continue to remain agile as we execute our long-term strategy to transition our business to a subscription revenue model while driving long-term value for all of our stakeholders.”

Based on its current view of business, Tufin provided third-quarter and full-year 2021 guidance.

For the third quarter, the company projects revenue to fall in the range of $23.5 – $27.5 million, while the consensus stands at $28 million.

For the full year 2021, Tufin forecasts revenue to be in the range of $105 – $113 million compared to the consensus estimate of $107.63 million.

Following the quarterly results, Cowen & Co. analyst Shaul Eyal maintained a Hold rating on the stock with a price target of $14, implying 27.6% upside potential to current levels.

Eyal notes that Tufin’s transition to the subscription-based model seems to be ahead of schedule, and he expects a re-acceleration of top-line growth.

The analyst said, “TUFN’s transition to a subscription model appears to be

tracking ahead of schedule. We are still early in the transition process, and while we await confirmation of durable revenue re-acceleration, we maintain our conservative stance yet remain positively constructive on the shares.”

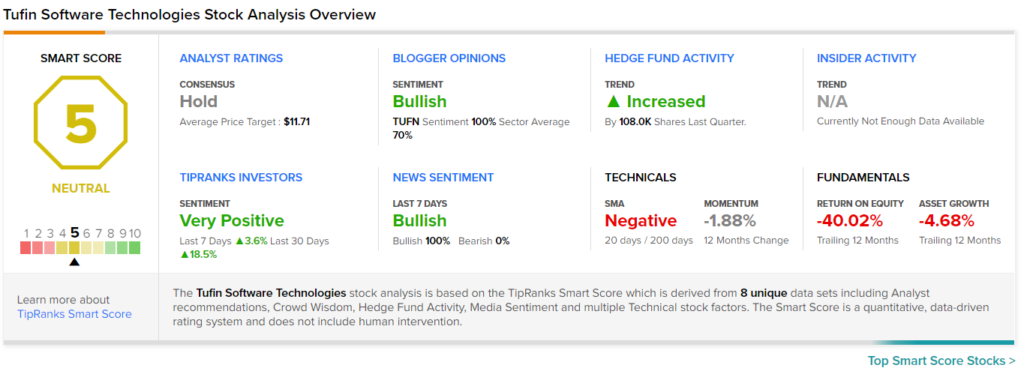

The stock has an overall Hold rating based on 2 Buys and 6 Holds. The average Tufin Software Technologies price target of $11.71 implies 6.8% upside potential to current levels. Shares have lost 5.4% over the past year.

Additionally, according to TipRanks’ Smart Score system, Tufin Software gets a 5 out of 10, which indicates that the stock is likely to perform in line with market averages.

Related News:

Haemonetics Exceeds Q1 Expectations; Shares Jump 7.4%

Similarweb Shares Plunge 17% Despite Strong Q2 Results

fuboTV Delivers Stellar Q2 Results; Shares Surge 16%