Digital advertising specialist The Trade Desk (NASDAQ:TTD) is reeling from a hit taken at Benchmark’s hands. The analysts reconsidered their position on the stock and declared it a sell. Some of Trade Desk’s investors did just that, but nowhere near as many as you might think; the stock is only down slightly in Thursday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Benchmark analyst Mark Zgutowicz turned his rating downward, lowering it from Hold to Sell. The basic reason behind the downgrade was pretty much what you’d expect: the digital advertising market is in a serious downturn. That, in turn, is placing “untenable” bullish expectations for the rest of this year that are likely to fall apart as quarterly earnings reports show up.

Indeed, Trade Desk projections look, perhaps, overly optimistic. Management looks for revenue growth of at least 20%. Zgutowicz, meanwhile, suggests that 15% is a much more realistic figure as far as year-over-year comparisons go. Clark Lampen at BTIG, who started coverage last week, agrees, noting that “slightly aggressive” consensus figures are in play.

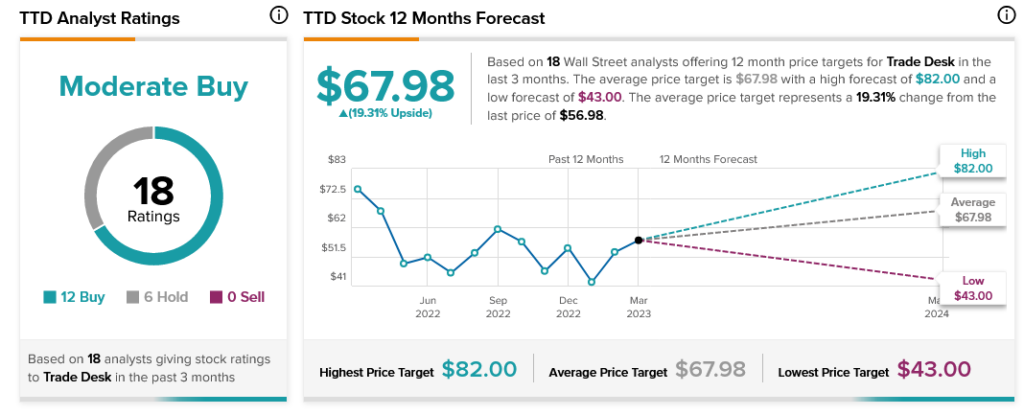

Overall, analyst consensus calls TTD stock a Moderate Buy, with a two-to-one ratio of Buy recommendations to Holds. Meanwhile, its average price target of $67.98 gives it an upside potential of 19.31%.