Taiwan Semiconductor Manufacturing Co. (TSM), or TSMC, shares moved higher on Thursday after the world’s leading contract chip maker posted a record 39% jump in third- quarter profit, driven by strong demand for AI and 5G chips.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

TSMC said its high-performance computing division, which includes chips made for artificial intelligence and advanced data centers, contributed over 55% revenues, driven by strong orders from major clients like Nvidia (NVDA) and Apple (AAPL). TSMC also predicted that AI-driven demand will keep rising and downplayed investor worries about trade tensions linked to the U.S.–China conflict.

TSMC Reports Strong Q3

For the third quarter, TSMC’s sales grew 30.3% year over year to NT$989.92 billion (about $33.1 billion), beating analyst estimates of $32.12 billion. Meanwhile, diluted earnings per share came in at NT$17.44 ($2.92 per ADR unit), up 39% year over year and above the $2.63 expected by analysts.

From a geographic view, North America remained TSMC’s largest market, contributing 76% of total revenue in the third quarter of 2025. Asia Pacific made up 9%, followed by China at 8%, Japan at 4%, and EMEA (Europe, the Middle East, and Africa) at 3% of total revenue.

Building on this strong performance, TSMC said demand for its 3-nanometer and 5-nanometer chips remained high across AI, data center, and smartphone markets. Its AI chips continue to be the main growth driver, supported by increasing global investment in data center capacity.

Q4 Guidance

For the fourth quarter, TSMC expects revenue between $32.2 billion and $33.4 billion, with gross margins in the range of 59% to 61%, supported by steady AI chip demand.

Is TSM a Buy, Sell, or Hold?

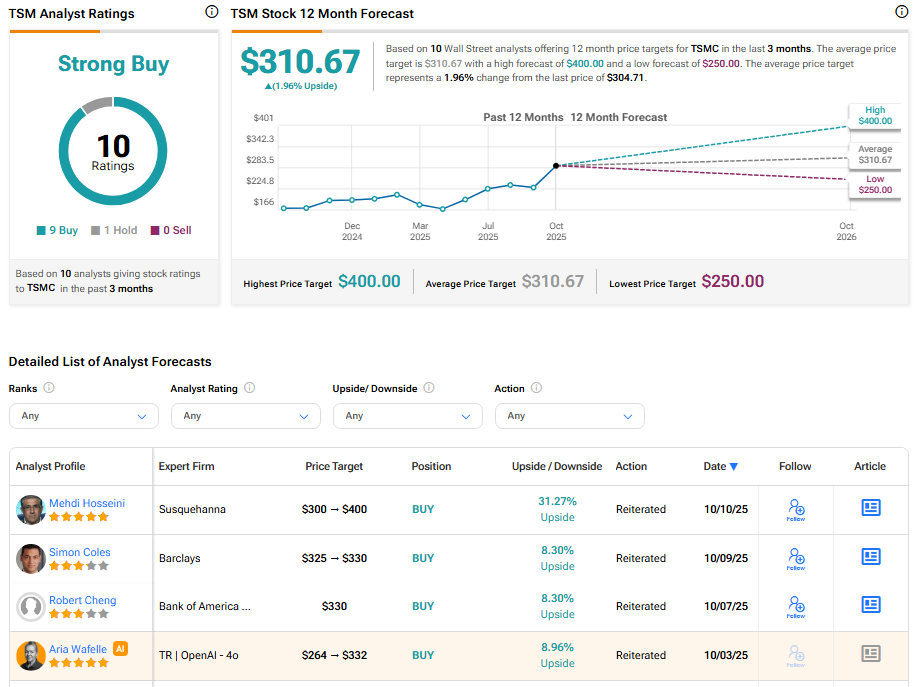

Turning to Wall Street, TSM has a Strong Buy consensus rating based on nine Buys and one Hold assigned in the last three months. At $310.67, the average TSMC price target implies 1.96% upside potential.

These ratings and price targets will likely change as analysts update their coverage following today’s earnings report.