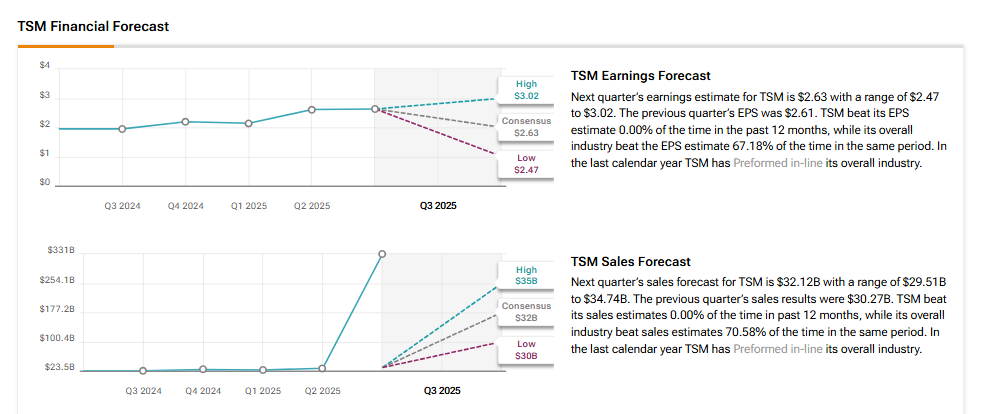

Taiwan Semiconductor Manufacturing (TSM) or TSMC, the world’s leading contract chip maker, is set to release its full third-quarter earnings results on October 16. TSM stock has gained about 43% over the past year, primarily due to strong demand for advanced chips, rising orders from key clients like Apple (AAPL) and Nvidia (NVDA), and improving chip supply conditions. Wall Street analysts expect the company to report earnings of $2.63 per share, representing a 35% increase year-over-year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, revenues are expected to increase by about 36% from the year-ago quarter to $32.12 billion, according to data from the TipRanks Forecast page.

Recent News Ahead of Q3 Print

Last week, TSMC reported net revenue of about NT$330.98 billion for September 2025. Revenues were up 31% year-over-year, but down 1.4% from August. Meanwhile, for January through September 2025, the company brought in revenue of NT$2,762.96 billion.

Analyst’s Views Ahead of TSMC’s Q3 Earnings

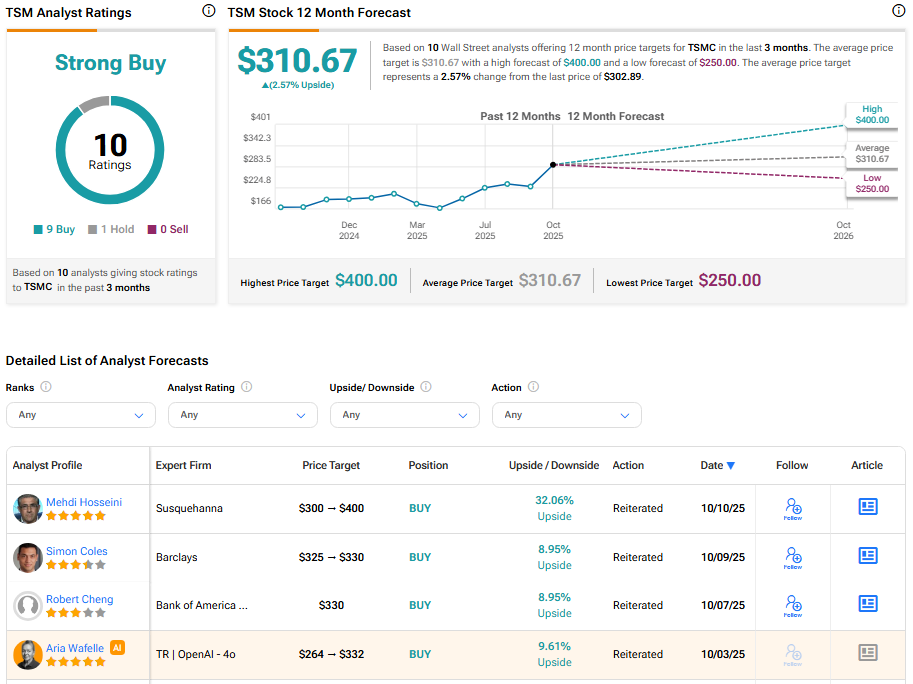

Ahead of TSM’s Q3 earnings, Susquehanna analyst Mehdi Hosseini raised the price target on the stock to $400 from $300 and kept a Buy rating. He expects the company to beat estimates and lift guidance when it reports results on October 16. Hosseini noted that Q4 2025 and Q1 2026 are tracking ahead of expectations, putting TSMC on pace for another strong year.

Similarly, Morgan Stanley maintained its Buy rating on the stock. The firm believes TSMC could lift its full-year revenue guidance on strong AI chip demand. The bank expects 2025 revenue growth to be revised up from 30% to 32–34% year-over-year, with high fab utilization and a possible 2026 price hike supporting the outlook.

Options Traders Anticipate a 5.88% Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 5.88% move in either direction.

Is TSM a Buy, Sell, or Hold?

Turning to Wall Street, TSM has a Strong Buy consensus rating based on nine Buys and one Hold assigned in the last three months. At $310.67, the average TSMC price target implies 2.57% upside potential.