Shares of Tesla (NASDAQ:TSLA) slipped at the time of writing after Barclays analyst Dan Levy downgraded Tesla from Buy to Hold despite simultaneously upping his price target from $220 to $260, reflecting the remarkable surge in Tesla’s share price within a month. Levy, however, adopted a cautious stance on Tesla’s immediate future, anticipating potential vehicle price cuts that might affect profit margins and earnings. On a more positive note, Barclays perceives Tesla as a long-term frontrunner in the electric vehicle industry. By late 2024-2025, Tesla is expected to ramp up the production of its lower-cost Model 2, an anticipation that promises to reinvigorate investor enthusiasm in the company.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Despite this downgrade, Tesla continues to make significant strides in the American automobile industry. The company’s Models Y, 3, X, and S all took the top four spots on the Cars.com list of the most American-made cars. Interestingly, neither Ford (NYSE:F) nor General Motors (NYSE:GM) made it to the top 10. Even though Tesla’s production spans across the globe, its U.S.-based factories in California and Texas significantly contribute to its recognition as a major player in the American auto industry.

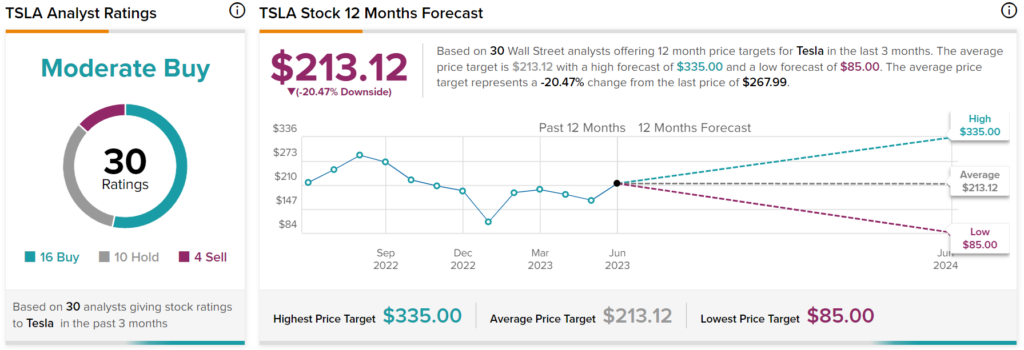

Overall, analysts have a Moderate Buy consensus rating on TSLA stock based on 16 Buys, 10 Holds, and four Sells assigned in the past three months, as indicated by the graphic above. Nevertheless, the average price target of $213.12 per share implies 20.47% downside potential.