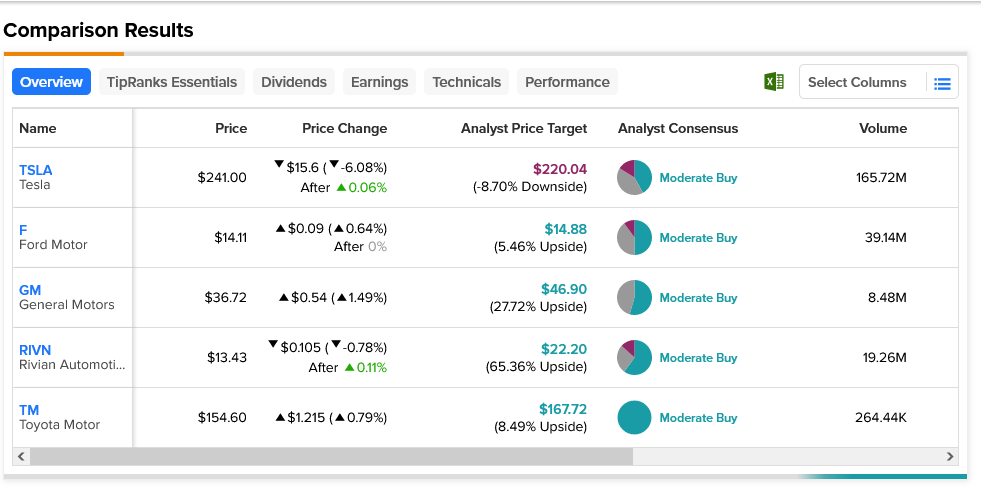

This year has been rough so far for investors in the auto sector. While there have been gains, there have been almost as many losses. With earnings season still a few weeks out for automakers, and some sales reports set to come in before that, we may see continued volatility in this sector. Just look at some of the biggest names in the sector today for all the proof you’ll need. One of the biggest losers in auto stocks today was electric vehicle stock Tesla (NASDAQ:TSLA). It slipped sufficiently to close down just over 6% in Monday’s trading session.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

That slide prompted a negative halo effect in fellow electric maker Rivian Automotive (NASDAQ:RIVN). However, not everyone was down in Monday’s trading session; legacy automakers Ford (NYSE:F) and General Motors (NYSE:GM), as well as Toyota Motor (NYSE:TM) were all up. GM was the only one up more than fractionally, however.

There’s a lot to watch out for going forward. S&P Global Mobility, for example, expects sales volume to, once again, be up, adding 17% on the strength of 1.38 million light vehicles sold. That would make for 11 months in a row of improved volume, a point which no doubt makes some wonder when the other shoe will drop. And, with a set of recalls hitting both Tesla and Ford in recent days, we can also see that the market doesn’t particularly care much about individual recalls unless they’re serious or otherwise mishandled.

When looking at Wall Street expectations, Tesla leads the way in one critical point: downside risk. Despite being a Moderate Buy by analyst consensus—interestingly, all five of the stocks mentioned today are considered Moderate Buys—it’s also the only stock with a downside risk of 8.7% thanks to its average price target of $220.04. Meanwhile, Rivian leads the way in upside potential; its $22.20 average price target allows it to offer 65.36% upside potential.