It seems that Tesla (NASDAQ:TSLA) has been struggling to create enough buzz around their vehicles lately. They’ve been slashing prices left and right, but according to Toni Sacconaghi of Bernstein, it’s not really doing the trick. Demand continues to be an issue, and those price cuts are only providing short-term relief. Sacconaghi estimates that Q1 run-rate demand will be about 1.2 million units, falling quite short of Tesla’s ambitious target of 1.8 million. As a result, he maintained an Underperform rating and a $150 price target, which caused shares to slip in today’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Tesla had its sights set on producing 3 to 4 million Model 3 and Y units per year. That’s nearly half of the market share in their categories. But Sacconaghi thinks that they aimed too high, especially considering the fragmented auto industry and the fact that many drivers aren’t quite ready to ditch their gas guzzlers for electric vehicles just yet. Thus, Tesla’s left to keep trimming prices, hoping to drum up more interest. The analyst even predicts that further cuts are coming for China and Europe in the second quarter.

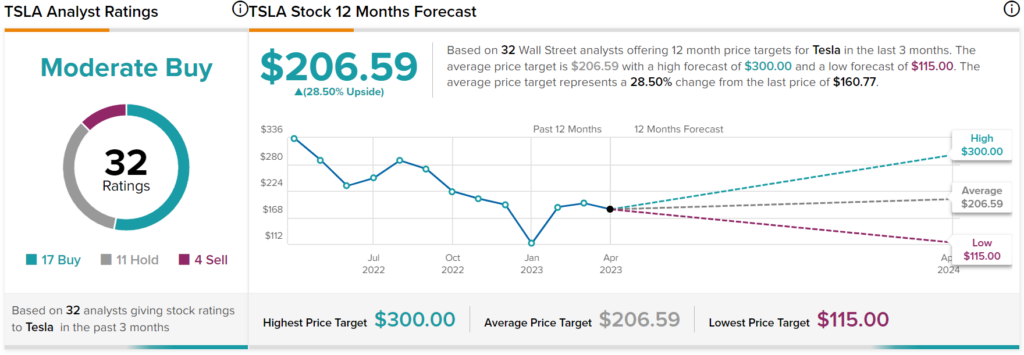

Overall, Wall Street analysts have a consensus price target of $206.59 on TSLA stock, implying 28.5% upside potential, as indicated by the graphic above.