“Volatility” is one of the key phrases that pay when you start talking about electric vehicle stocks. A stock that starts the day up could lose all its gains by lunchtime. And even then, it might still start a halo effect that extends to other names throughout the industry. That’s just what happened today, as Nikola (NASDAQ:NKLA), Lordstown Motors (NASDAQ:RIDE), and Workhorse (NASDAQ:WKHS) gained ground and gave Canoo (NASDAQ:GOEV), and even Tesla (NASDAQ:TSLA) a little extra help today.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

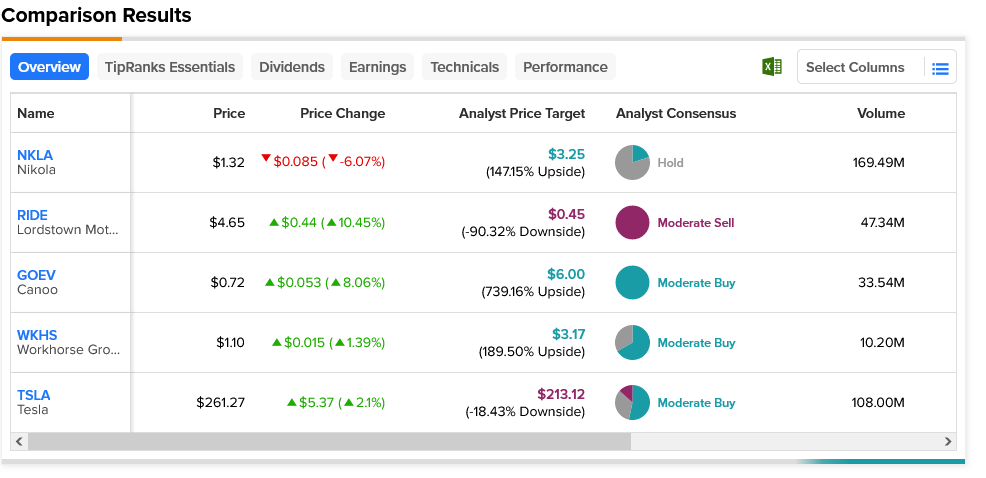

Yet “volatility” remained the watchword. Nikola was one of the three stocks that led gains throughout the sector, but it lost most of that ground and then some throughout Friday’s trading. It bolted up 12.86% in premarket action, but by a little after lunchtime, it had lost that entire gain and was down just over 6%. Yet, Lordstown, which added 5.95% in the morning, expanded its lead to over 10% by Friday afternoon. Workhorse built on a Thursday surge into premarket on Friday, but by Friday afternoon, watched most of that gain dissolve to be up only 1.39%.

One of the biggest gainers in Friday afternoon trading was Canoo, who was up 8.06% at one point. Even Tesla, notching up just under 1% in premarket, expanded its gain to 2.1% in Friday afternoon’s trading. Much of the gains could be traced to Tesla’s new connections with Ford (NYSE:F) and General Motors (NYSE:GM), which saw Tesla’s North American Charging Standard become a lot more standard. That’s leading to potential investors becoming a lot more accepting of the risks involved with these stocks.

Indeed, “volatility” is the name of the game here, and “risk” isn’t far behind. For instance, Canoo stock—today’s second-highest gainer among the aforementioned stocks at one point—is considered a Moderate Buy by analyst consensus. But thanks to its $6 average price target, it comes with a gobsmacking 739.16% upside potential. Meanwhile, Lordstown stock, a Moderate Sell, comes with a 90.32% downside risk on its average price target of $0.45 per share.