The Commodity Futures Trading Commission (CFTC), the U.S. agency in charge of regulating cryptocurrency and derivatives markets, is facing a leadership crisis. Trump’s pick to lead the CFTC, Brian Quintenz, has remained unconfirmed for several months amid a crypto battle with the Winklevoss twins.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, instead of the normal five commissioners, the CFTC currently has just one confirmed commissioner, Republican acting chair Caroline Pham. Pham has taken action to independently fire and reassign enforcement employees, leaving the agency in a vulnerable position.

“To prevent excess speculation, the CFTC has to be an aggressive cop on the commodity beat,” said Better Markets’ Dennis Kelleher. “There’s nobody today that’s fearing the CFTC.”

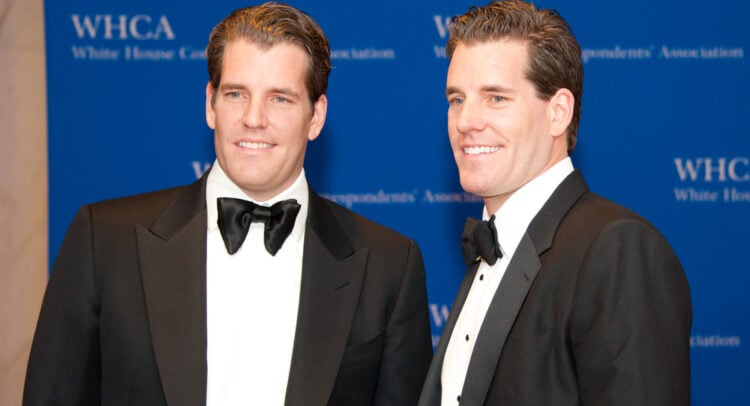

Quintenz Faces Pressure from Winklevoss Twins Over 2022 Gemini Case

Quintenz has suggested that his confirmation as CFTC Chair is facing pressure from the Winklevoss twins, who own the Gemini cryptocurrency exchange. Back in 2022, the CFTC accused Gemini of making misrepresentations to regulators. The case was settled for $5 million, although the twins have continued to criticize the agency’s handling of the dispute.

Earlier this month, Quintenz posted a conversation between himself and the Winklevoss twins regarding the case in an X post. In the messages, Quintenz refused to take a position on the case, saying that only a fully confirmed chair should decide how to proceed.

“It’s my understanding that after this exchange they contacted the President and asked that my confirmation be paused,” Quintenz said in the post.

Stay ahead of macro events with our up-to-the-minute Economic Calendar — filter by impact, country, and more.