President Donald Trump may soon lose majority control of his own media company — and it’s all because of a $2.5 billion Bitcoin bet. Trump Media & Technology Group (DJT) revealed plans Tuesday to sell a flood of new stock and convertible notes to fund a massive crypto play. The fallout? Trump’s voting power could drop below 50%, stripping him of the final word over Truth Social.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Bitcoin-Backed $2.5B Raise Threatens Trump’s Grip on DJT

The company will issue $1.5 billion in new equity and $1 billion in convertible notes, according to SEC filings. The proceeds are earmarked for direct Bitcoin purchases, making Trump Media one of the first public companies to embrace crypto at this scale. But the math is simple: more shares equals more dilution.

Before the move, Trump (through a trust in Don Jr.’s name) controlled 52% of shares. After the raise, that figure could slide to 41%. That’s below majority — and with no dual-class voting rights, Trump can now be outvoted by shareholders.

Trump’s Name, Not Trump’s Call

The stock trades under DJT. The brand is unmistakable. But the voting structure isn’t. Trump placed his holdings in a revocable trust, which he can reclaim, but that doesn’t shield him from shareholder math. The shares sold Tuesday went to institutional investors, not the Trump family.

At the moment, Trump’s name sits on the door. But in a corporate vote, the final say might not.

University of Florida professor Jay Ritter says Trump fans might not vote against him, but that’s not a certainty. “It’s unlikely 100% of the other shareholders would vote in opposition,” he said. “But it’s also not guaranteed.” Without a special share class, one angry fund could change the outcome.

Convertible Notes Add Fuel to Fire

The $1 billion in notes can be turned into shares at $34.72. If that happens, Trump’s control slips even further. Unlike a simple raise, convertible debt brings ongoing dilution risk — every conversion chips away at the family’s stake.

Nunes Gets Paid, while Stock Tanks

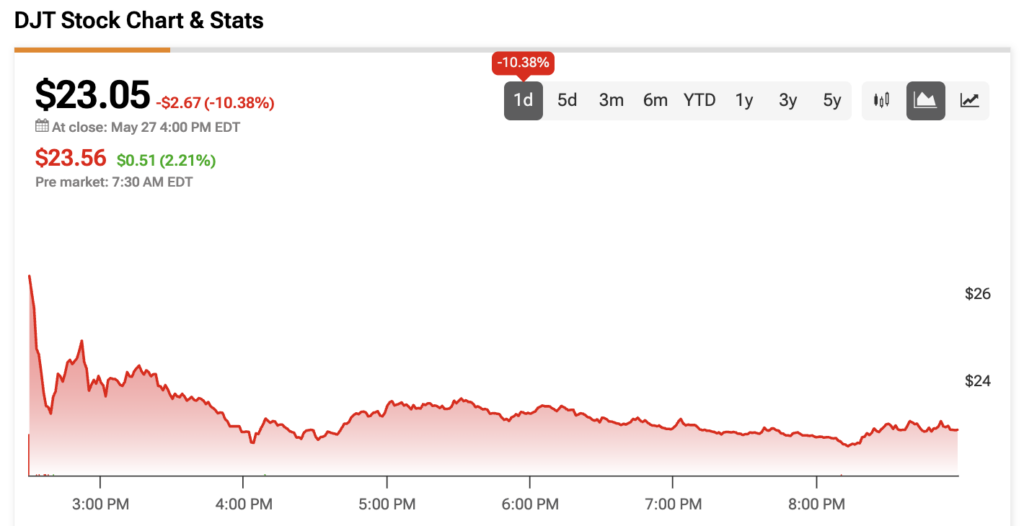

CEO Devin Nunes pulled $47.6 million in comp last year, while Trump Media booked just $3.6 million in revenue. That’s a 13-to-1 pay ratio. Meanwhile, DJT stock fell 10% to $23.05 on Tuesday. The Nasdaq closed up 2.5%.

Unless Trump, Don Jr., or close allies start buying back in, the numbers point to a new chapter: Trump, who once held over 52% of DJT stock, may soon become the figurehead of a company he no longer controls. Meanwhile, institutions like Vanguard and Fidelity are quietly building their footprint behind the scenes.