President Donald Trump may be preparing to announce new tariffs on imported cars as early as Wednesday, according to a Bloomberg report that cites unnamed sources. This comes just days after Trump told reporters that auto tariffs could arrive even before April 2, when a larger batch of reciprocal tariffs is set to target countries with large trade surpluses with the U.S. The White House hasn’t provided an official timeline or details on how steep these auto tariffs might be. When asked about the timing, one administration official told Reuters, “I’d take him at his word.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Bloomberg also noted that one person close to the situation said the plans could still change, leaving room for uncertainty. Trump previously floated the idea of a 25% tariff on imported vehicles back in February but hasn’t followed up with more specifics since then. If implemented, the auto tariffs could have a big impact on international carmakers and further raise trade tensions. Unsurprisingly, this has led Barclays to lower its year-end forecast for the S&P 500 (SPX) from 6,600 to 5,900.

The bank pointed to the potential negative effects of U.S. tariff policies on economic growth as the main reason for the downgrade. In its revised base case, Barclays expects U.S. economic activity to slow due to new tariffs, though not enough to trigger a recession. The bank also cut its 2025 earnings-per-share estimate for the S&P 500 from $271 to $262. Barclays estimates the direct impact of these tariffs could reduce S&P 500 earnings by 1.6%, with an additional 0.7% downside if affected countries retaliate.

Is SPY a Buy Right Now?

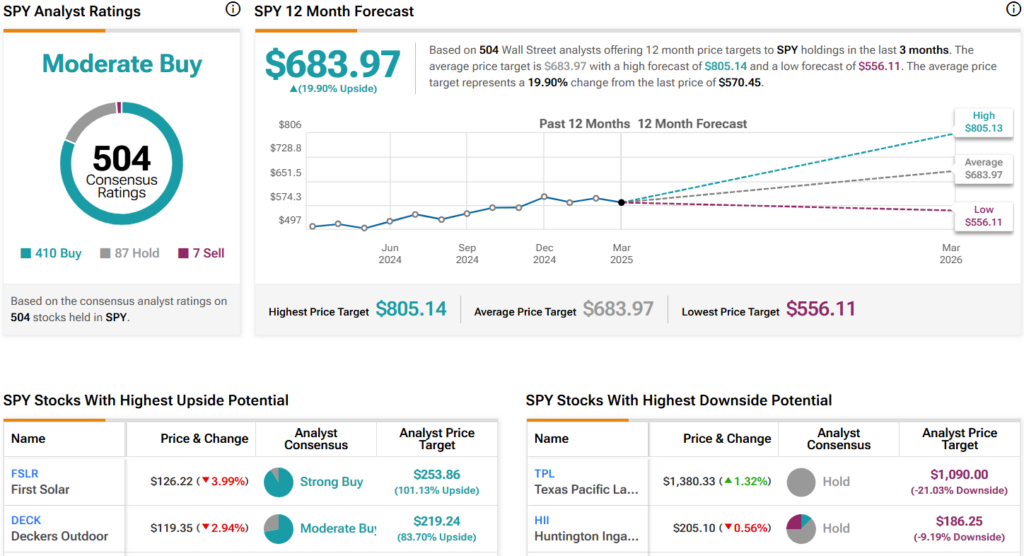

Turning to Wall Street, analysts have a Moderate Buy consensus rating on the SPDR S&P 500 ETF Trust (SPY) based on 410 Buys, 87 Holds, and seven Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average SPY price target of $683.97 per share implies 19.9% upside potential.