Financial services provider Truist Financial (NYSE:TFC) delivered a better-than-anticipated set of third-quarter numbers, with EPS of $0.84 coming in ahead of expectations by $0.03. While revenue of $5.73 billion declined by 2.6% year-over-year, the figure still exceeded the consensus estimate by about $20 million.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

During the quarter, net interest income declined by 1.6% to $3.62 billion from the previous quarter. Additionally, seasonally lower insurance income and a decrease in deposit service charge fees resulted in TFC’s noninterest income declining by 8.1% to $2.11 billion.

Importantly, while average deposits remained stable, the company managed to improve its net interest margin by four basis points to 2.95%. The company is looking to lower expenses with its $750 million cost savings program, which is expected to help contain expense growth at flat to up 1% in 2024. It is also focusing on reducing higher-cost borrowings and paring back non-core and lower-return portfolios.

Looking ahead to the fourth quarter, TFC expects revenue growth to be flat to down by 1%, with an anticipated 3.5% decline in adjusted expenses. For the full Fiscal year 2023, adjusted revenue is anticipated to rise by about 1.5%.

What Is the Forecast for TFC Stock?

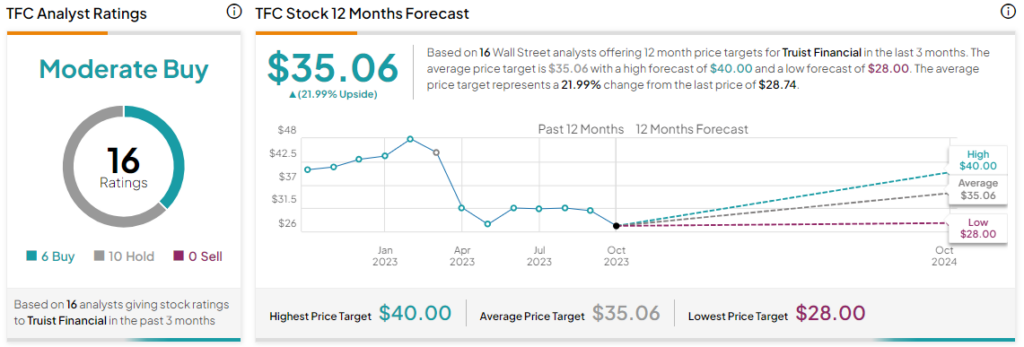

Overall, the Street has a Moderate Buy consensus rating on Truist. The average TFC price target of $35.06 implies a nearly 22% potential upside. That’s after a nearly 34% slide in the share price over the past year.

Read full Disclosure