Several factors are coming together for electric vehicle stock Tesla (NASDAQ:TSLA) and they’re not looking good. Trouble is brewing from the government, and concerns are rising in the analyst sector over potential margin troubles. None of this seems to trouble investors much, though, as Tesla is up slightly in Monday afternoon’s trading session.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Senator Elizabeth Warren took aim at Tesla recently, calling for investigations into the company on several fronts. The senator called for not only Tesla to be investigated, but also the Tesla board of directors as well. Warren specifically cited “…conflicts of interest, misappropriation of corporate assets, and other negative impacts to Tesla shareholders…” including those stemming from the Twitter takeover. The request for such a sweeping investigation was sent to Gary Gensler, chairman of the Securities and Exchange Commission, on Monday.

That alone would be bad enough, but several analysts are starting to express concern about Tesla’s margins. One of these is Wedbush’s Daniel Ives, who delivered the phrase “Margins, margins, margins” to display his concern prominently. In fact, some are even positing that the Cybertruck itself—which only recently started rolling off production lines—is little more than a smokescreen to hide the issues Tesla is facing with its numbers. Wells Fargo forecast that the gross margin on vehicles will ultimately fall to 17.5% thanks to the ongoing price war in electric vehicles.

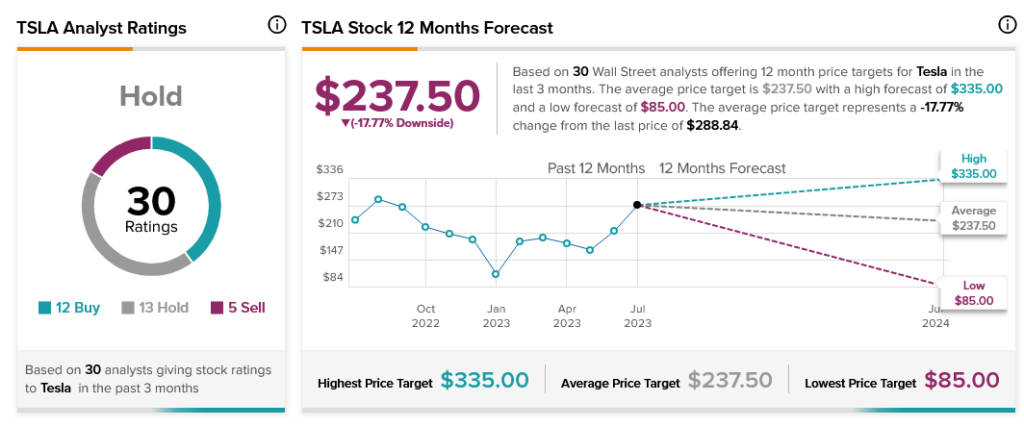

Tesla’s troubles are likely contributing to the schism in analyst circles. The combination of 12 Buy ratings, 13 Hold and five Sell leaves Tesla stock as a consensus Hold. Moreover, with an average price target of $237.50, Tesla stock currently comes with a worrying 17.77% downside risk.