Tricon Residential (TSE: TCN), announced the launch of Tricon Vantage on Wednesday, a market-leading program aimed at providing its U.S. residents with tools and resources to set financial goals and improve their long-term economic stability.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tricon Residential owns and operates single-family homes and multi-family rental apartments in the United States and Canada

Helping Residents Improve Financial Well-Being

Tricon Vantage is offering the following new services: Financial Literacy; Credit Builder; Resident Home Purchase Program; Resident Emergency Assistance Fund; and Resident Down Payment Assistance Program.

CEO Commentary

Tricon Residential president and CEO Gary Berman said, “We have always recognized that long-term business success depends on the success of our residents and the communities where we operate. When families have the stability necessary to build pathways to their own financial freedom, entire communities can prosper. At Tricon, we believe that this compassionate approach to serving our residents is not only the right thing to do, but also the contributing factor to our high occupancy, industry-low turnover rate and leading resident satisfaction scores.”

Wall Street’s Take

On December 6, Goldman Sachs analyst Chandni Luthra initiated coverage on TCN with a Buy rating and a price target of $16.50 (C$20).

Luthra stated, “We initiate coverage of Tricon Residential (NYSE and TSX: TCN) with a Buy rating and see 17% upside to our $16.50 12-month price target (19% TSR including a 2% dividend yield) for US-listed shares and 16% upside to our $21 12-month price target for Canadian-listed shares. TCN presents a unique value proposition with its single-family rental offering, strong growth opportunities in both internal and external channels, a key differentiator in its strategic capital platform, and a sector-leading operating platform. Relative to FactSet consensus, our 2022/23 FFOPS estimates are +4%/+5%.”

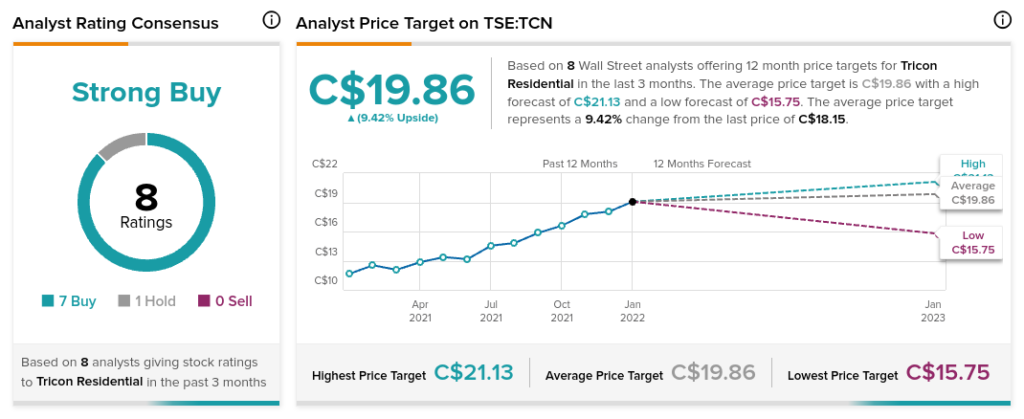

The rest of the Street is bullish on TCN with a Strong Buy consensus rating based on seven Buys and one Hold. The average Tricon Residential price target of C$19.86 implies 9.4% upside potential to current levels.

Download the TipRanks mobile app now

Related News:

The Real Brokerage Buys Expetitle

SNC-Lavalin Gets 3 New Contracts from UKAEA