Shares of digital advertising solutions provider Tremor International (NASDAQ:TRMR) are down nearly 24% in the pre-market session today after the company posted lower-than-expected second-quarter numbers on top-line as well as bottom-line fronts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue rose 11.1% year-over-year to $84.2 million but missed the cut by ~$12.8 million. Moreover, EPS at $0.06 came in much lower than the Street’s anticipated $0.21 mark. During the quarter, Programmatic revenue rose by 26% over the prior year owing to the integration of the Amobee platform. Further, gains in CTV market share helped Tremor drive a 5% growth in CTV revenue as well. Video revenue now makes up 71% of Programmatic revenue and Tremor expects this share to only rise higher as it benefits from video-related cross-selling opportunities.

Amid a challenging macroeconomic environment, Tremor is witnessing longer sales cycles and lower overall take rates. Against this backdrop, Tremor now expects full-year 2023 adjusted EBITDA in the range of $85 million to $90 million versus the prior outlook between $140 million to $145 million.

Further, full-year ex-TAC contribution is now anticipated between $320 million to $330 million as compared to prior expectations of about $400 million.

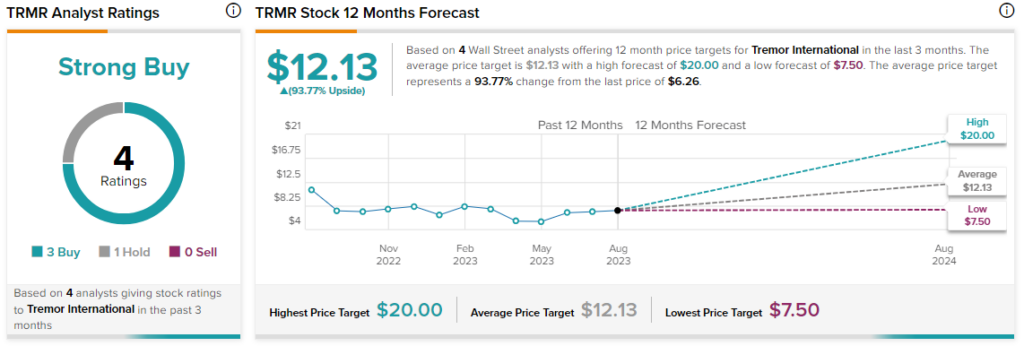

Overall, the Street has a $12.13 consensus price target on Tremor alongside a Strong Buy consensus rating. This points to a massive 93.8% potential upside in the stock.

Read full Disclosure