Trip.com Group (NASDAQ:TCOM) delivered better-than-expected results for the fourth quarter of 2022. The provider of online travel and related services witnessed strong demand in international business, which was partially offset by the spread of COVID-19 in China during the quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Adjusted earnings per ADS of $0.11 in the fourth quarter exceeded the Street’s expectations of a loss of $0.03 and compared favorably with the earnings of $0.08 reported in the same quarter last year. Meanwhile, Trip.com’s Q4 net revenues declined nearly 1% year-over-year to $729 million but surpassed analysts’ expectations of $703.3 million.

Other key metrics showed that hotel bookings increased 140% and overall air ticket bookings on the company’s global platform grew 80% from the prior-year quarter.

For the full year 2022, Trip.com reported revenues of $2.9 billion, down 6.5% from the previous year. Adjusted earnings per ADS declined 12.1% from the prior year to $0.29.

Looking forward, Trip.com is expected to benefit from the resumption of China’s outbound travel at the beginning of 2023. Further commenting on the global travel industry scenario, the company’s Executive Chairman James Liang said, “During the fourth quarter, the European and the U.S. markets made further progress towards normalcy while the Asia market was quickly picking up the pace.”

Is TCOM Stock a Buy?

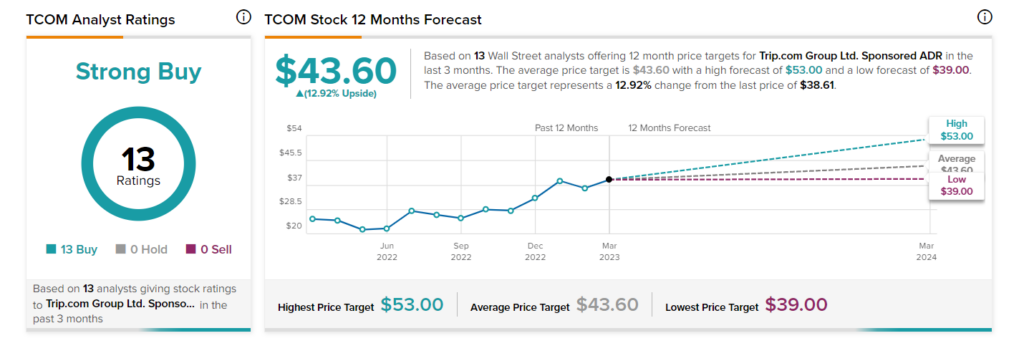

Currently, Wall Street is highly optimistic about the company’s growth prospects. TCOM commands a Strong Buy consensus rating based on 13 unanimous Buys. The average price target of $43.60 implies an upside potential of 12.9% from the current level. Shares of the company have gained 8.2% so far in 2023.