TransAlta Corporation (TA) announced Tuesday its renewables growth objectives and declared a dividend increase of 11%. TransAlta owns, operates and develops a diverse portfolio of power generation assets in Canada, the United States, and Australia.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Strategic growth goals include adding 2 GW of new capacity to the company’s fleet, and investing approximately C$3 billion in the development, construction and acquisition of new assets by the end of 2025.

TransAlta will accelerate growth with focus on customer-centric renewables and storage through the execution of its 3 GW development pipeline. (See TransAlta Corp. stock charts on TipRanks)

TransAlta president and CEO John Kousinioris said, “We have significant growth aspirations across Canada, the United States and Australia with a focus on renewable and storage power solutions for large customers. As we look forward to 2025, we are confident in our investment strategy and the decision to expand further into contracted renewables with onshore wind, solar and battery storage across our platform.

“We believe this enhanced customer focus on renewable generation and storage will provide significant value for our shareholders.”

The Board of Directors has approved an 11% increase of its dividend on common shares to C$0.05 (C$0.20 on an annualized basis). This is the third dividend increase in the past two years.

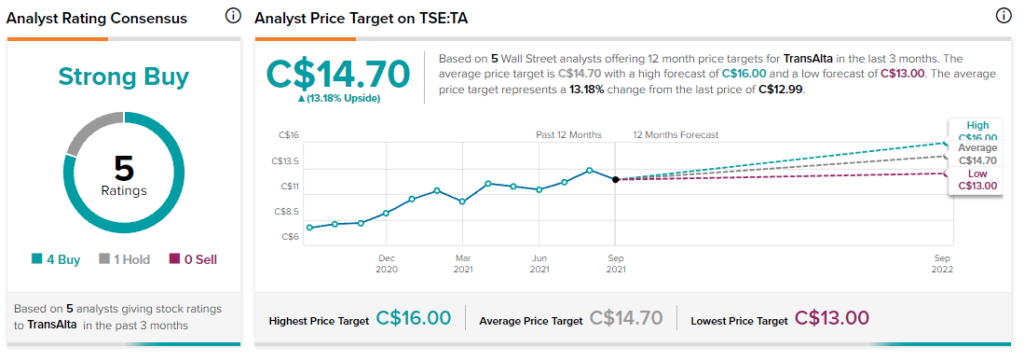

Last week, BMO Capital analyst Benjamin Pham maintained a Buy rating on the stock, with a price target of C$16. This implies 23.7% upside potential.

The rest of the Street is bullish about TA, with a Strong Buy consensus rating based on four Buys and one Hold. The average TransAlta price target of C$14.70 implies an upside potential of about 13.2% to current levels.

Related News:

Agnico Eagle to Buy Kirkland Lake Gold

Crescent Point Raises Dividend; Shares Pop 11%

Enbridge Buys U.S. Gulf Coast Light Export Platform