Currently, a lot of electric vehicle makers are reconsidering—particularly legacy automakers like Toyota Motor (NYSE:TM)—whether or not to even be in the field at all. And if so, by how much. But Toyota is looking to not only maintain its current presence, but even expand it substantially. In fact, Toyota has plans to expand its truck line to start including plug-in hybrids or even full electric trucks.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

With revised emissions rules coming from the government, more automakers are looking to electric or hybrid models to meet the new standards. Taking the chance that they may be revoked with a changing of the guard come November isn’t a worthwhile plan to most. Currently, Toyota is evaluating its pickup line, specifically the Tacoma and Tundra models, to see if more electric models can fit in the market somewhere. It’s considering customer demand as well as the changing regulatory landscape, among other things.

Toyota’s Worldwide Sales Are in Open Decline

This revelation comes at a very good time for Toyota, too. Recent reports note that Toyota’s worldwide sales are in open decline, down 7% in February alone. The two biggest rough spots, meanwhile, were in China and Japan. While pivoting to electric and hybrid models in the U.S. might not be much help, perhaps pivoting in those countries could be helpful.

However, given that some of the Japanese slump resulted from troubles in the safety testing department, introducing new lines of pickup trucks may not be particularly helpful. Still, with the right marketing angle about how well those trucks are tested, Toyota might be able to turn it around in Japan.

Is Toyota Motor a Good Buy?

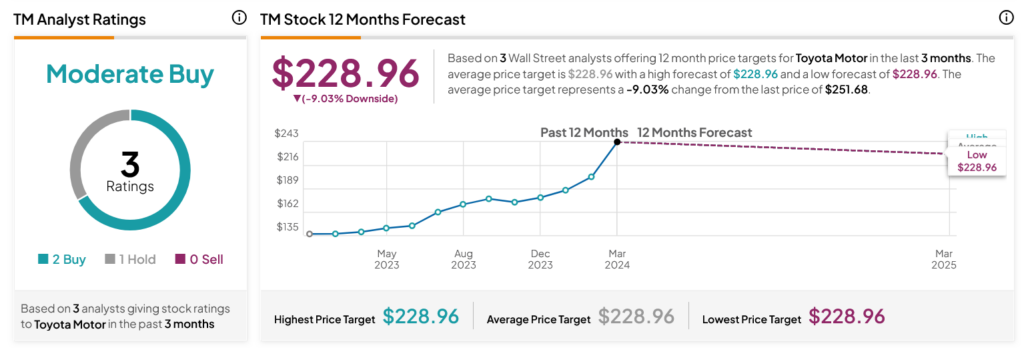

Turning to Wall Street, analysts have a Strong Buy consensus rating on TM stock based on two Buys and one Hold assigned in the past three months, as indicated by the graphic below. After an 80.26% rally in its share price over the past year, the average TM price target of $228.96 per share implies 9.03% downside risk.