Shares of TotalEnergies (TTE) gained 2.9% in early trade on Monday after the company signed a strategic partnership agreement with Safran, a French multinational aircraft engine, rocket engine, aerospace-component and defense corporation, to develop technical and commercial solutions to reduce CO2 emissions of the aviation industry.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

TotalEnergies is an oil and gas company that produces and markets fuels, natural gas and low-carbon electricity.

The companies are targeting to speed up reduction of the CO2 emissions of the aviation industry to achieve net-zero CO2 emissions by 2050. Sustainable aviation fuel (SAF) is said to play an important role in this approach. (See TotalEnergies stock charts on TipRanks)

In the short term, the companies will be making current engines compatible with fuel containing up to 100% SAF, which in the long run is expected to optimize engine/fuel energy efficiency and environmental performance.

Furthermore, the partnership could also be expanded to include other fields such as adapting fuel systems to SAF or developing new-generation battery systems for electric motors.

The Chairman and CEO of TotalEnergies, Patrick Pouyanné, said, “This strategic alliance will contribute to the emergence of a French value chain for sustainable aviation fuel and electric aircraft. TotalEnergies is resolutely committed to reducing its own carbon emissions and to supporting its customers in their reduction efforts by offering innovative, tailored solutions.”

On September 17, J.P. Morgan analyst Christyan Malek downgraded the rating on the stock to a Hold with a price target of $56.3 (20.8% upside potential from current levels). Malek is of the opinion that there are limited catalysts for TotalEnergies shares.

Overall, the rest of the Street is bullish on the stock and has a Strong Buy consensus rating based on 3 Buys and 1 Hold. The average TotalEnergies price target of $58.08 implies upside potential of about 24.6% from current levels.

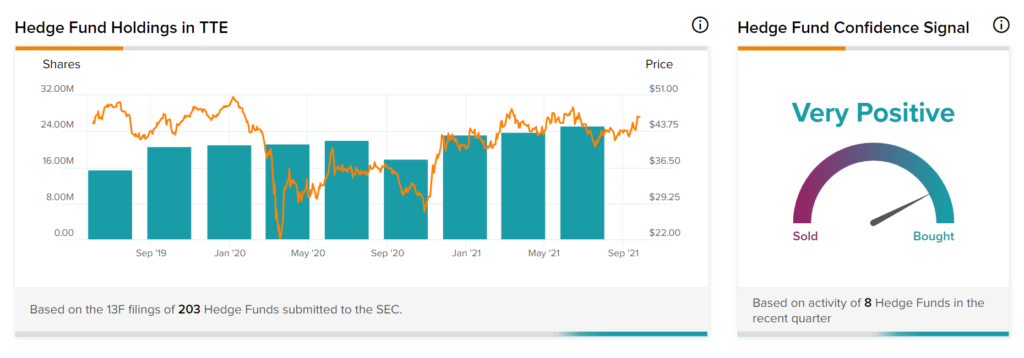

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in TotalEnergies is currently Very Positive, as the cumulative change in holdings across all eight hedge funds that were active in the last quarter was an increase of 1.3 million.

Related News:

PPL Corporation Gets FERC Approval to Acquire Narragansett Electric

Tesla’s Shanghai Factory Produced 300,000 Cars Amid Chip Shortages – Report

Roku Introduces Streaming Player Line-Up in Germany