Shares of energy giant TotalEnergies (NYSE:TTE) are ticking higher in the pre-market session today after the company signed a 27-year LNG (Liquified Natural Gas) supply deal with QatarEnergy, according to Reuters.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Impressively, this is the biggest and longest European gas supply deal for Qatar. The two companies have entered into two long-term sales and purchase supply agreements for delivery. The transaction will involve the supply of up to 3.5 million metric tons of LNG to a receiving terminal in southern France. Deliveries are anticipated to begin in 2026.

Qatar plans to expand its liquefaction capacity from 77 million metric tons annually to 126 million by 2027. TTE and QatarEnergy have two joint ventures with interests in Qatar’s North Field East and North Field South projects.

In a separate development, TTE has been accused of “involuntary manslaughter and a failure to assist people in danger” during terrorist attacks in Mozambique in 2021. The company has rejected the accusations from the survivors and relatives of victims of the attack and noted the role played by its Mozambique LNG teams in evacuating over 2,500 people from the company’s Afungi site.

What is the Target Price for TTE?

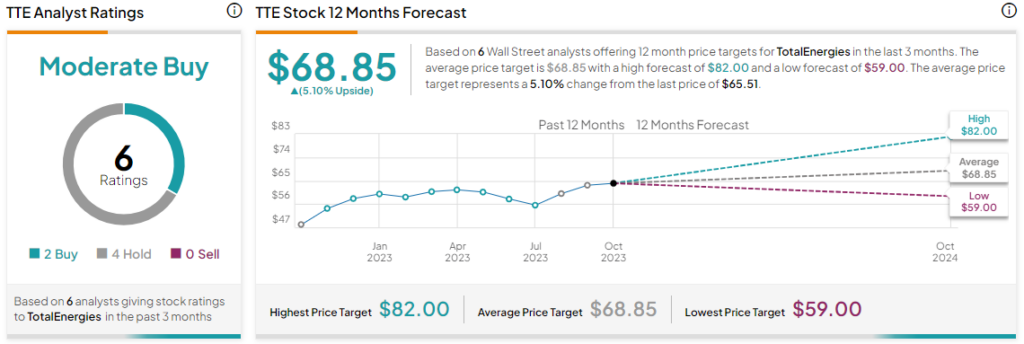

Overall, the Street has a Moderate Buy consensus rating on TTE. The average TotalEnergies price target of $68.85 implies a modest 5.1% potential upside.

Read full Disclosure