Drugmaker Viatris’ (NASDAQ:VTRS) chief information officer Ramkumar Rayapureddy has been accused of insider trading by the Securities and Exchange Commission. Also, the Department of Justice has levied criminal charges on Rayapureddy.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to the complaint, between September 2017 to July 2019 (when Viatris was known as Mylan), Rayapureddy kept tipping his former colleague, Dayakar R. Mallu, insider information regarding drug approvals, earnings results, and the planned merger of Mylan with Pfizer’s (NYSE:PFE) division Upjohn.

The regulator informed that with these tips, Mallu was able to earn about $8 million, a portion of which was shared with Rayapureddy. Last year, the SEC charged Mallu with these accusations, to which he pleaded guilty.

Rayapureddy’s charges come just days after the company impressed investors with plans to expand its eyecare business by undertaking two acquisitions. Also, Viatris reported a Q3 earnings beat and reiterated its full-year 2022 outlook.

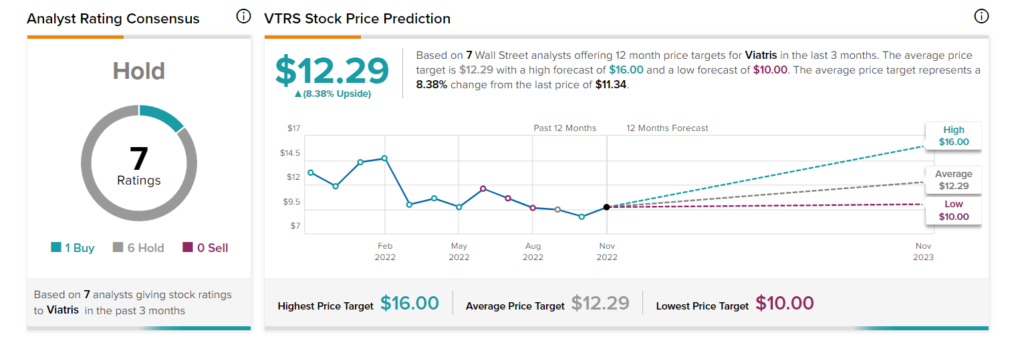

Is Viatris a Buy, Sell or Hold?

Viatris stock has a Hold consensus rating based on one Buy and six Holds. The average Viatris stock price target of $12.29 implies upside potential of 8.38%.