Investment firm Jefferies recently compiled a list of stocks with the strongest negative correlation to the 10-year Treasury yield. It’s no secret that treasury yields have an impact on the stock market. Specifically, the 10-year Treasury yield, which is commonly used as a benchmark in valuation models.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Generally, when yields rise, it makes stocks look less attractive, and the opposite is true when they fall. This is because treasuries are considered “risk-free,” so stock valuations need to compensate investors for the additional risk incurred from investing in equities.

Which Stocks to Buy When Interest Rates Fall?

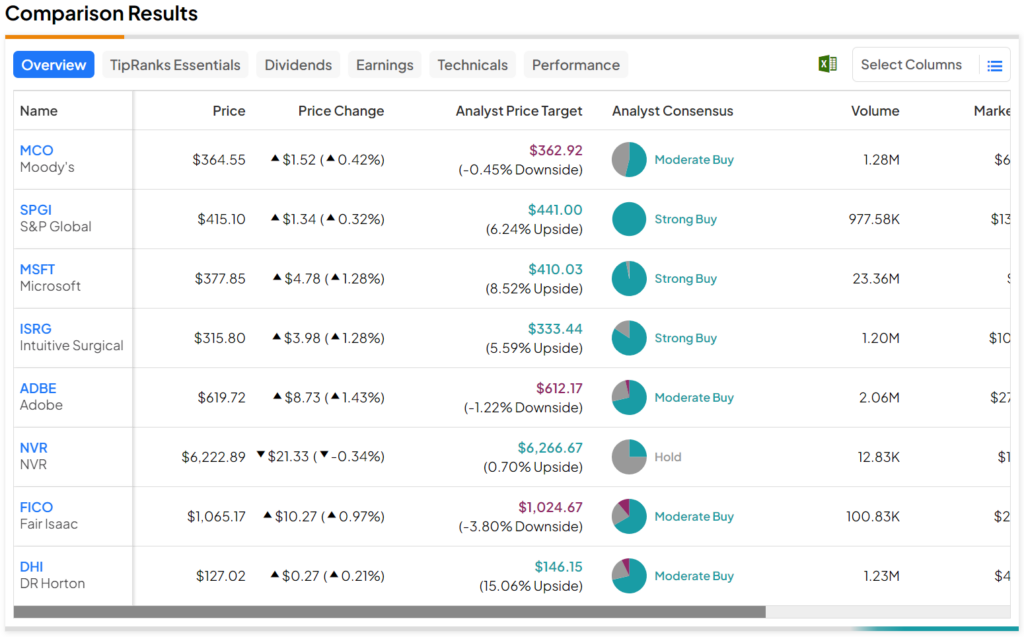

The stock with the strongest negative correlation to interest rates was Moody’s (MCO), coming in at -0.43 on a scale of -1 to 1. It was closely followed by S&P Global (SPGI) at -0.41. Other notable names on the list included:

- Microsoft (MSFT): -0.22

- Intuitive Surgical (ISRG): -0.28

- Adobe (ADBE): -0.30

- NVR (NVR): -0.30

- Fair Isaac (FICO): -0.34

- DR Horton (DHI): -0.39

It’s worth noting that the firm screened for companies based in the U.S. with market caps greater than $4 billion. In addition, the correlation was calculated based on the past three years.

Furthermore, when looking at analyst consensus estimates, it appears that Wall Street expects the most upside potential from DHI stock out of the aforementioned stocks. Indeed, its price target of $146.15 per share implies over 15% upside potential from current levels.