Black Friday, the biggest retail event on the calendar, is around the corner, putting e-commerce stocks in the limelight. Consumers are looking forward to big savings, while retailers are gearing up for spending season to commence.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Black Friday is no longer a one-day event. Not only does it start early, with deals becoming available in advance, but it is followed by Cyber Monday, and in recent years has also represented the kick-off to the festive spending bonanza ahead of Christmas.

That’s not the only change. Once upon a time, Black Friday conjured up images of crowds of people stampeding into stores. That is shifting, 2020 saw more online sales than ever before, and that trend could well continue this year, as Covid continues to spread and e-commerce grows.

What does this mean for investors? On the one hand, Black Friday doesn’t necessarily have much effect on the long-term investor. However, sales during the five-day Thanksgiving period can be a good indicator of consumer sentiment for the fourth quarter. And this can affect retail sector stocks.

TipRanks’ new Website Traffic feature places individual investors in a stronger position than ever before with their stock research. You now have tools to see a company’s estimated website traffic before it reports earnings.

With that in mind, these 5 eCommerce stocks for this shopping season, have a Strong or Moderate Buy analyst rating consensus and at least 10% upside potential over the next 12 months.

Best Black Friday Stocks:

Alibaba (NYSE: BABA)

Analyst consensus: Strong Buy

Upside potential: 57.96%

YTD website traffic comparison: +3.46%

2021 hasn’t been kind to the Chinese e-commerce giant, Alibaba. In the shadow of China’s crackdown on tech companies, the stock has fallen close to 50% year-to-date. However, Wall Street analysts are optimistic it will make a comeback. BABA has almost 58% upside potential, based on the ratings of 21 Wall Street analysts. Meanwhile, looking at both the Alibaba and AliExpress domains, the company has seen a 3.46% growth in traffic year-to-date when compared to last year.

Chewy (NYSE: CHWY)

Analyst consensus: Moderate Buy

Upside potential: 30.28%

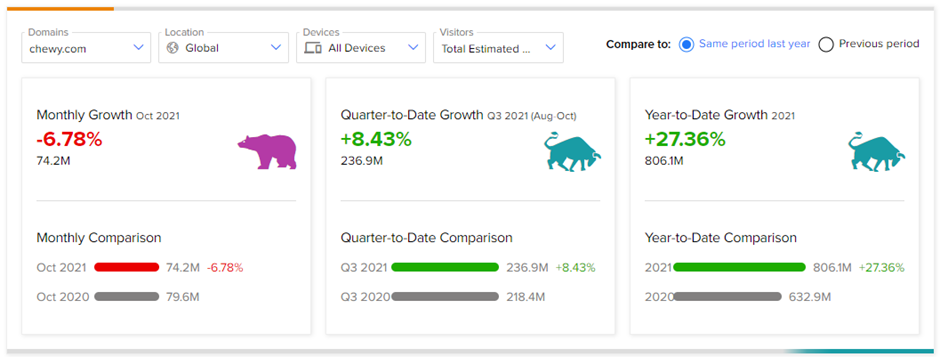

YTD website traffic comparison: +27.36%

Online pet retailer Chewy started 2021 strongly. Its stock reached $120 in March, only to see its price plummet. Can it recover? Analysts are divided. The stock has received ten Buy and six Hold ratings in the past three months. This gives it a Moderate Buy consensus, with a price target that represents a 30.28% upside.

Notably, the company is showing significant growth according to its estimated website traffic. Although website visits in October 2021 were down compared to October 2020, year-to-date, website traffic visits have increased by over 27% when compared to the same period last year.

Walmart (NYSE: WMT)

Analyst consensus: Strong Buy

Upside potential: 20.90%

YTD website traffic comparison: +12.44%

For the second time ever, Walmart, the world’s largest retailer will close all its U.S. stores on Thanksgiving Day. The company’s website traffic has grown dramatically at 12.44% year-to-date compared to 2020. Although the stock has slightly declined over the past 12 months, investors have benefitted from its 1.49% dividend. Out of 20 analysts who have rated the stock in the past three months, 16 have given it a Buy rating and four a Hold rating. The average price target represents 20.90% upside.

Overstock (NASDAQ: OSTK)

Analyst rating consensus: Strong Buy

Upside potential: 13.50%

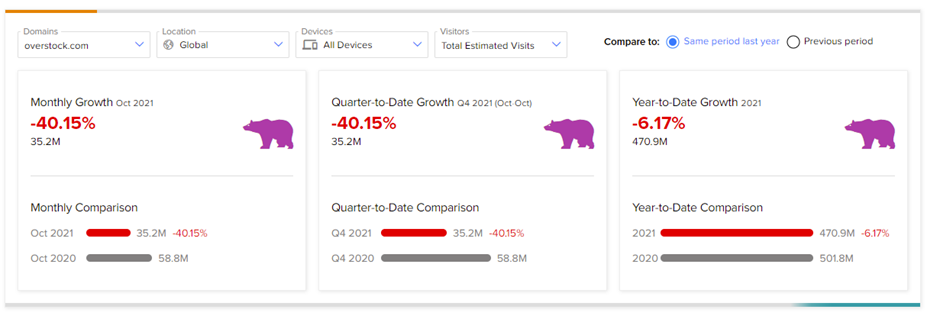

YTD website traffic comparison: +-6.17%

Online retailer Overstock has seen whopping growth in the past year, with its stock increasing by close to 75%. The four analysts who have rated the stock in the past three months see room to grow. All rated the stock a Buy and their average price target indicates 13.50% upside. While the stock price has increased, the number of website visits has gone down. The company’s monthly growth decreased by over 40% compared to last October and year-to-date growth has declined by 6.17%.

Amazon (NASDAQ: AMZN)

Analyst rating consensus: Strong Buy

Upside potential: 11.20%

YTD website traffic comparison: +3.44%

Stock of the world’s largest online retailer Amazon has continued to climb, and analysts continue to see room for growth. The stock’s price has risen almost 13% over the past 12-months and all 30 analysts who have rated AMZN over the past three months say Buy. Their average price target indicates over 15% upside. Although Amazon.com’s year-to-date website traffic has declined 2.39% compared to last year, when looking at all nine of the company’s subdomains, which include Whole Foods and Twitch TV, it has increased by 3.44%. That’s 70.3 billion visits to these websites.

Disclaimer: The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.