At TipRanks, we provide our investors with several tools to help them make better investment choices. The Top Hedge Fund Managers tool keeps you informed about the trading activities of the most significant hedge funds in the world. Read more about how the Hedge Fund Managers tool provides you with updated information about hedge funds’ trades.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

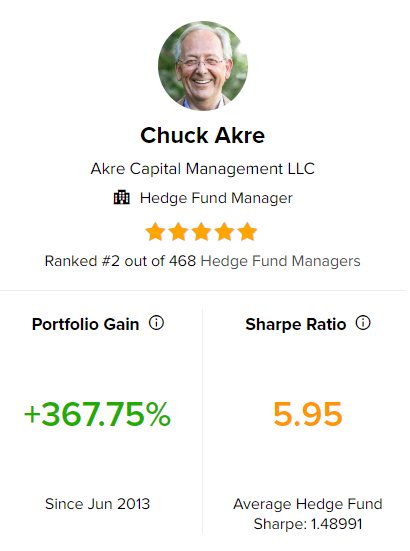

One such top hedge fund manager is Chuck Akre, the CEO, and chief investment officer of Akre Capital Management LLC. According to the TipRanks Star Ranking, Akre bags the second spot among 468 top Hedge Fund managers covered by TipRanks.

Remarkably, since June 2013, Akre’s portfolio has gained 367.75%, which is more than the 240% return generated by the S&P 500 (SPX) over the same time period.

Further, a hedge fund manager’s return on a portfolio is best measured by the Sharpe ratio, which measures the portfolio’s returns against its risks. A Sharpe ratio greater than one means that the portfolio has higher returns than risks. Akre has a Sharpe ratio of 5.95.

A majority of Akre’s investments are focused on the Financial sector (36.6%), followed by the Technology sector (26.7%). The hedge fund manages $11.34 billion in assets under management.

Now let’s take a look at three picks from Akre’s portfolio.

Mastercard (NYSE:MA)

Mastercard is a payments and technology company that globally connects consumers, businesses, merchants, issuers, and governments. It has a market capitalization of $342.37 billion. The company delivered upbeat results for the third quarter as it surpassed both earnings and revenue estimates.

Moreover, the company’s future seems bright, as it is expected to benefit from the rise in credit card usage since inflation continues to pinch consumers’ pockets. Also, Mastercard’s capital deployment activities are impressive. It recently announced a 16.3% quarterly dividend hike along with a new stock buyback program of up to $9 billion.

MA takes the number one spot in Akre’s holdings, as it makes up 14.75% of the overall portfolio, valued at $1.68 billion.

Overall, Mastercard has a Strong Buy consensus rating based on 18 Buys and one Hold. The average MA price target of $395.94 implies 13.9% upside potential to current levels.

American Tower Corporation (NYSE:AMT)

Based in Massachusetts, American Tower is a cell-tower real estate investment trust. This $100.39 billion company independently owns and operates wireless and broadcast communications infrastructure in several countries.

The company’s Q3 performance was impressive. Moreover, American Tower has the potential to gain from the 5G wireless boom and efforts to grow its tower portfolio at the international level.

The stock constitutes 13.11% of Akre’s portfolio, with a total holding value of $1.5 billion.

Wall Street is optimistic about AMT. It has a Strong Buy consensus rating based on nine Buys and three Holds. The average stock price target is $241, which implies 13.4% upside potential.

Moody’s Corporation (NYSE:MCO)

The credit rating and risk analysis company has a market capitalization of $53.37 billion. MCO delivered a disappointing performance in the third quarter. Moody’s also slashed the outlook for the full year, citing current macroeconomic uncertainty as a key woe.

With an exposure of 12.2%, Moody’s occupies the third position in Akre’s portfolio. The value of MCO stock held is $1.39 billion.

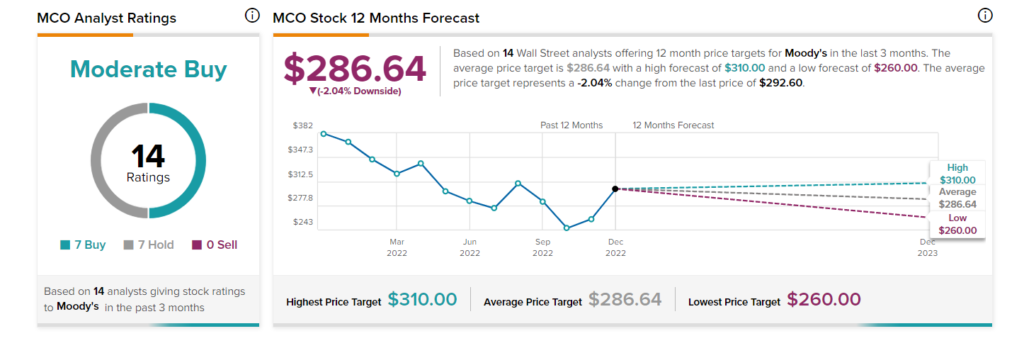

On TipRanks, MCO stock has a Moderate Buy consensus rating. This is based on seven Buys versus seven Holds. The average price target of $286.64 implies 2.04% downside potential.

Ending Thoughts

Akre’s track record of impressive returns may motivate investors to follow his portfolio allocation strategy in order to optimize their investment returns. For more ideas on our Top Expert Picks, you can visit the TipRanks Expert Center and make informed investment decisions.

Want to know which Hedge Fund managers to follow and which stocks they’re buying? Give TipRanks Premium a try.