Equifax Inc. (NYSE: EFX) is in trouble as Maxine Waters, a California Democrat, strongly urged the Consumer Financial Protection Bureau (CFPB) to hold “Equifax and its leadership accountable” for the issuance of wrong credit scores to millions of customers from mid-March to early April.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Based in Georgia, the $26.9-billion company provides human resources, business process outsourcing, and information solutions services to its customers, including consumers, businesses, and governments.

According to a Wall Street Journal report, the Chairwoman of the House Financial Services Committee wants CFPB to take “more robust enforcement action” versus fines against the consumer credit reporting agency.

The U.S. Representative finds it appropriate for CFPB to bar Equifax from releasing credit scores on consumers, including people wanting credit cards, mortgages, and auto loans until all the issues are resolved with the company.

It is worth mentioning that Equifax failed to protect its system from hacking in 2017, which resulted in the leaked personal information of almost 150 million consumers. In light of this incident and the recent one, the Congresswoman opined that the company “is quickly becoming a recidivist bad actor.”

How Equifax Reacted to Maxine Waters’ Criticism

In response to multiple queries from Maxine Waters, Equifax’s CEO, Mark Begor, said, “We can confirm that this issue, which was related to a legacy technology platform, was fixed months ago, and we have further strengthened our processes and data controls since that time. We are working closely with our customers on this issue and stand behind our customers and impacted consumers.”

Is Equifax Stock a Buy, Nonetheless?

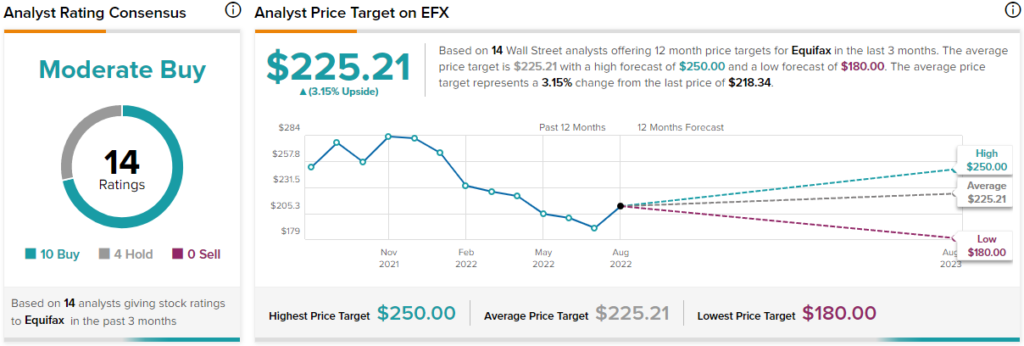

Despite the aforementioned issues, Wall Street analysts have awarded 10 Buy ratings against four Holds to Equifax stock. The company has a Moderate Buy consensus rating. EFX’s average price forecast is $225.21, suggesting 3.2% upside potential from current levels.

In addition, hedge funds are “Very Positive” on the stock, having increased their holdings by 1.8 million shares in the last quarter.

Finally, financial bloggers are 100% Bullish on EFX stock versus the sector average of 68%.

Considering analysts, bloggers, and hedge fund sentiments, Equifax could be attractive to prospective investors. The strength in the company’s workforce solutions business, product innovations, and synergies from acquired businesses (it agreed to acquire Mitigator and LawLogix in July) would likely be beneficial in the upcoming quarters.