Top benchmark analyst Mark Zgutowicz upgraded Trade Desk (TTD) stock to Buy from Hold with a price target of $65 following the company’s better-than-expected Q3 results and fourth-quarter outlook. Zgutowicz contended that while TTD continues to face macroeconomic uncertainties and is waiting for its restructuring efforts to deliver the desired benefits, most of the earlier relative industry growth concerns are now behind it.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Despite strong Q3 results, TTD stock fell 6.3% on Friday amid weakness in the broader market, rising capital expenditure, concerns about growing competition, and the potential impact of macro uncertainties on ad spending. Trade Desk shares have declined 63% year to date.

Benchmark Analyst Upgrades TTD Stock to Buy

Zgutowicz noted that Trade Desk’s Q3 revenue (excluding political spend related to last year’s election) grew about 22% year over year, driven by new growth drivers, such as “decisioned” CTV (connected TV), retail media, partnerships with major brands and agencies, and international business.

Furthermore, the 5-star analyst highlighted that Q3 revenue beat accounted for about two-thirds of the adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) upside, while the remaining one-third came from careful hiring and continued operating expense efficiencies.

Given the reacceleration in Q3 revenue and no mention of tariff pressure on Trade Desk’s major brand clients (which was a concern last quarter), Zgutowicz thinks that Q4 revenue growth guidance (excluding political ads) of 18.5% seems very conservative.

Looking ahead, Zgutowicz expects innovative solutions, such as OpenPath, OpenAds, and Deal Desk, to be “critical differentiators” for TTD that will drive notable AI-driven efficiency and address concerns that the company’s products may become too generic. Overall, the top-rated analyst believes that TTD stock, which is currently trading at a 5-year low valuation multiple of 16x Enterprise Value (EV)/NTM (next 12 months) EBITDA, is looking “considerably oversold.”

Is TTD a Good Stock to Buy?

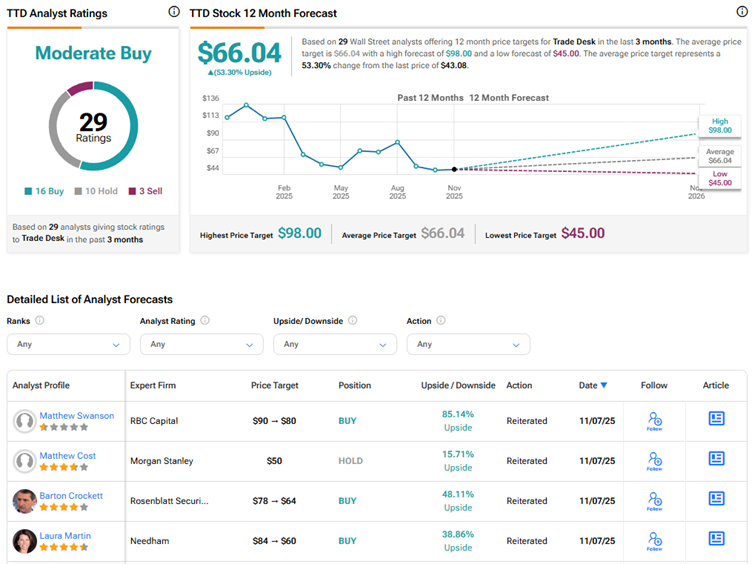

Currently, Wall Street has a Moderate Buy consensus rating on Trade Desk stock based on 16 Buys, 10 Holds, and three Sell recommendations. The average TTD stock price target of $66.04 indicates 53.3% upside potential from current levels.