Tesla (TSLA) delivered a record-breaking 497,099 vehicles in Q3 2025, surpassing expectations and marking its first year-over-year delivery increase of the year. The upside was largely driven by a demand surge ahead of the September 30 expiration of U.S. federal EV tax credits. While a couple of Top analysts acknowledged the strong quarter, they remain cautious about what lies ahead for the EV giant.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Top Analysts Reiterate a Hold on Tesla Stock

Oppenheimer’s Colin Rusch maintained a neutral stance on Tesla despite the strong delivery numbers. He believes this upside was already priced in, given policy changes and investor anticipation.

Looking ahead, Rusch expects investors to focus on Tesla’s Q4 vehicle sales, autonomous driving progress, and the timeline for humanoid robot shipments. Due to high expectations and Tesla’s recent stock rally, he expects the stock to be flat or slightly down following the news.

It must be highlighted that Tesla stock was down 3.4% during Thursday’s trading session.

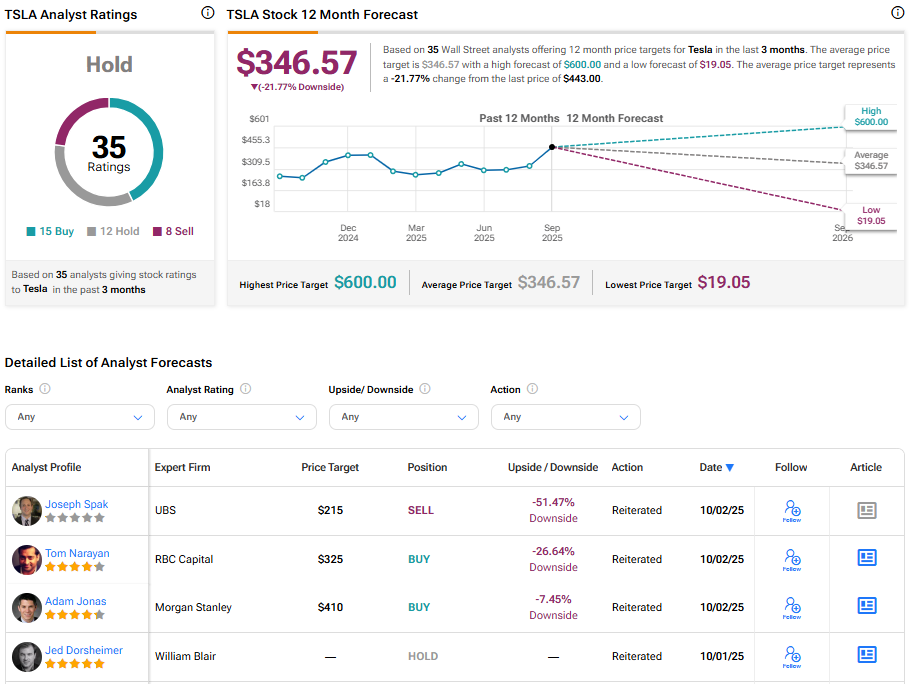

At the same time, William Blair’s Jed Dorsheimer reiterated a Hold rating on TSLA stock. Despite the strong results, the five-star analyst raised valuation concerns, with Tesla trading at 118x projected 2026 EBITDA, far above tech peers at 20–25x.

He also highlighted risks such as intense competition from Chinese EV and energy storage companies, geopolitical tensions due to large exposure to customers in China, and “key-man risk tied to CEO Elon Musk.”

What Is the Prediction for Tesla Stock?

Turning to Wall Street, TSLA stock has a Hold consensus rating based on 15 Buys, 12 Holds, and eight Sells assigned in the last three months. At $346.57, the average Tesla price target implies a 21.77% downside risk. The stock has gained 71.9% over the past six months.