Data center infrastructure provider Vertiv Holdings (VRT) reported market-beating third-quarter revenue and earnings on Wednesday, thanks to robust artificial intelligence (AI)-driven demand for its offerings, including power and cooling solutions. Several Wall Street analysts noted the company’s strong performance, with many top analysts raising their price targets.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Vertiv Delivers Impressive Q3 Results

Vertiv Holdings reported a 29% rise in its Q3 2025 sales to $2.68 billion, exceeding the Street’s estimate of $2.58 billion. Moreover, the company’s Q3 orders accelerated, with organic orders surging about 60% year-over-year and 20% sequentially from the prior quarter. VRT ended the quarter with a strong backlog of $9.5 billion. The company’s Q3 earnings per share (EPS) jumped 63% to $1.24, driven by a 220 basis points expansion in its adjusted operating margin to 22.3%.

Vertiv raised its full-year sales and earnings guidance, driven by solid Q3 results and continued momentum in demand for its AI infrastructure. The company now expects adjusted EPS to be in the range of $4.07 to $4.13, up from the previous outlook of $3.75 to $3.85. It expects net sales in the range of $10.16 billion to $10.24 billion, up from its prior outlook of $9.925 billion to $10.075 billion.

Top Analysts Lift VRT Stock Price Targets

Following the Q3 print, Oppenheimer analyst Noah Kaye raised the price target for Vertiv Holdings stock to $195 from $190 and reiterated a Buy rating. The 5-star analyst noted that VRT stock experienced uneven trading amid the broader market selloff on Wednesday, despite the company reporting record Q3 orders and a robust EPS beat. He views the Q3 commentary as incrementally bullish.

Kaye believes that VRT’s backlog may exit FY25 with a 35% increase, creating clear upside to the Street’s 2026 growth estimates. He also noted that order strength has yet to include recent large AI infrastructure deals, Europe, the Middle East and Africa (EMEA) recovery, or material benefits from the Rubin transition. Kaye is also optimistic about VRT, as he believes that a “return to 30-35% incrementals” at a higher top-line CAGR (compound annual growth rate) compared to Investor Day 2024 targets could enable the company to achieve its long-term margin targets sooner than anticipated. Consequently, Kaye raised his 2025-27 estimates and increased his price target.

Likewise, Evercore analyst Amit Daryanani increased his price target for VRT stock to $210 from $200 and reaffirmed a Buy rating. The 5-star analyst noted that VRT delivered an impressive Q3 print, driven by strength in its North America and Asia-Pacific businesses, partially offset by weakness in the EMEA region. Daryanani thinks that the unfavorable reaction in VRT stock reflects a flattish Q4 EBIT margin outlook and the weakness in EMEA.

Daryanani believes that VRT remains well-positioned to show revenue acceleration in 2026 versus the Street’s expectation of sales decelerating by 10 points, which he thinks will result in a sizable beat when VRT formally issues its guidance for the next year. He is impressed with the company’s backlog and highlighted that the backlog/orders for VRT consist of “FIRM PURCHASE ORDERS— implying that the multiple of sizable engagements we have seen recently (OpenAI/NVDA, ORCL RPO, etc) are likely all upside levers over the next several years.”

The analyst added that while EMEA performance was weaker than anticipated, VRT expects to see an acceleration in the second half of 2026, supported by the deployment of AI inferencing infrastructure that must be established in-region and in-country to meet sovereignty and latency requirements.

Is VRT Stock a Good Buy?

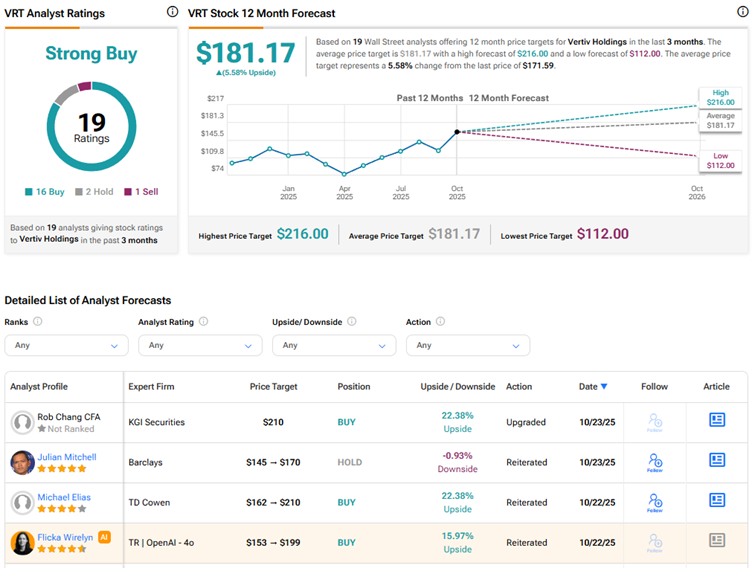

Currently, Wall Street has a Strong Buy consensus rating on Vertiv Holdings stock based on 16 Buys, two Holds, and one Sell recommendation. The average VRT stock price target of $181.17 indicates 5.6% upside potential from current levels.