Artificial intelligence (AI) infrastructure company Oracle (ORCL) is scheduled to announce its results for the first quarter of Fiscal 2026 after the market closes on Tuesday, September 9. Ahead of the Q1 earnings, top analysts at Barclays, Morgan Stanley, and JPMorgan raised their price targets for Oracle stock. ORCL stock was up 3.4% as of writing. Let’s look at the reasons provided by these top analysts for their increased price targets.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Meanwhile, Wall Street expects Oracle to report earnings per share (EPS) of $1.48 for Q1 FY26, reflecting 6.5% year-over-year growth. Revenue is expected to rise 13% from the prior-year quarter to $15.04 billion.

Top Analysts Raise Price Target for ORCL Stock

Barclays analyst Raimo Lenschow raised his price target for Oracle stock to $281 from $221 and reiterated a Buy rating. The 5-star analyst contends that while Q1 FY26 is generally a small seasonal quarter, this year it will be different for the company, as investors will focus on the $30 billion annual recurring revenue (ARR) announced in June.

Meanwhile, JPMorgan analyst Mark Murphy increased the price target for Oracle stock to $210 from $185, but maintained a Hold rating. The top-rated analyst noted that Oracle is benefiting from momentum across the technology industry’s AI infrastructure bookings. That said, Murphy is sidelined on ORCL stock, as he believes that shares are trading at a relatively premium multiple.

Furthermore, Morgan Stanley analyst Keith Weiss increased his price target for Oracle stock to $246 from $175, while maintaining a Hold rating. The 5-star analyst’s higher price target indicates solid momentum in the AI infrastructure business and a higher long-term revenue estimate. The analyst stated that Oracle’s FY29 revenue target could be revised upwards to $125 billion at the upcoming Analyst Day, from $104 billion, supported by recent contract wins and a rising backlog.

However, Weiss added that growing gross margin pressure indicates FY29 EPS in the range of $11.50 to $12.00, compared to the Street’s consensus estimate of $12.29. The analyst currently prefers to be on the sidelines on ORCL stock, as he awaits greater visibility on long-term margins.

TD Cowen Analyst Weighs in on Oracle’s Q1 Earnings

Another top analyst, TD Cowen’s Derrick Wood, reiterated a Buy rating on Oracle stock with a price target of $325. Wood stated that investors will mainly focus on the performance of Oracle Cloud Infrastructure (OCI) and the company’s remaining performance obligations (RPO). Wood sees modest upside to SaaS and OCI growth estimates, including his Cloud growth estimate at 29%. He expects momentum in RPO to build as demand for AI training workloads continues to ramp and the company progresses towards its more than $275 billion RPO target set for FY26.

Wood highlighted that his firm’s checks indicate robust OCI demand from the company’s largest customers, building momentum in multi-cloud deployments from the core base, and rising migrations to its Fusion offering. He contends that OCI’s growth potential for FY26 is still underappreciated and undermodeled.

Is Oracle Stock a Buy, Sell, or Hold?

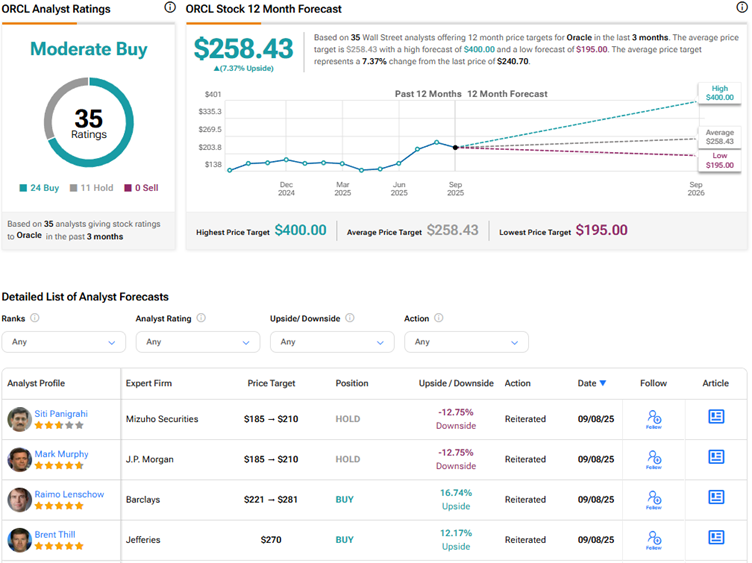

Heading into Q1 FY26 earnings, Wall Street has a Moderate Buy consensus rating on Oracle stock, based on 24 Buys and 11 Holds. The average ORCL stock price target of $258.43 indicates 7.4% upside potential from current levels.