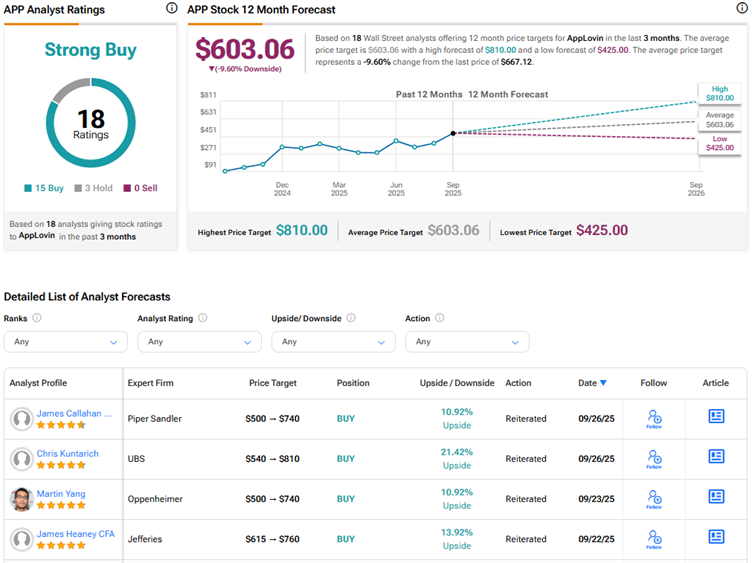

Shares of artificial intelligence (AI)-powered ad tech company AppLovin (APP) were up 4.7% on Friday and have surged more than 105% year-to-date. Even after such an impressive rally, top analysts at UBS and Piper Sandler see further upside potential in APP stock. Piper Sandler analyst James Callahan boosted his price target for AppLovin stock to $740 from $500, while UBS analyst Chris Kuntarich raised his price target to $810 from $540. Both analysts reaffirmed a Buy rating on APP stock, reinforcing their bullish stance on the AI play’s growth potential.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Aside from AI tailwinds, APP stock has also gained due to its inclusion in the S&P 500 Index (SPX).

Top Analysts See Further Upside Potential in APP Stock

Kuntarich stated that he continues to view AppLovin stock as a “Top Pick” in his coverage. The 5-star analyst added that over the next 12 months, he expects the company’s demand and supply expansion initiatives to improve the efficacy of its Axon 2.0 AI-powered ad engine and drive estimates and multiple upside.

Additionally, Kuntarich noted that following the Q2 print, web-based advertiser checks indicate robust demand for the referral program and an opportunity to increase visibility among agencies targeting Fortune 1000 brands. Coming to mobile gaming checks, the analyst said, “We don’t see anything indicating APP’s leadership is being challenged.”

Meanwhile, Piper Sandler’s Callahan stated that he is “excited” about the soft launch of AppLovin’s Axon Ads Manager on October 1. He noted that management is confident about the product, which the top-rated analyst thinks is warranted. Callahan highlighted that AppLovin is expanding into a 20 times larger market, with early signs indicating the potential for the company to be a top advertising player. “While we expect the rollout to be challenging and non-linear, excitement seems appropriate,” said Callahan.

Is APP a Good Stock to Buy?

Overall, Wall Street has a Strong Buy consensus rating on AppLovin stock based on 15 Buys and three Holds. The average APP stock price target of $603.06 indicates a possible downside of about 10% from current levels.