Earnings season is about to kick off and Wall Street’s biggest names will all be under the microscope. Among them, Amazon (NASDAQ:AMZN) undoubtedly takes center stage, as the ecommerce giant gears up for its Q1 report. With the stock hovering just shy of its all-time high of $186.12, reached in July 2021, anticipation is palpable.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to TD Cowen’s John Blackledge, the shares will soon be surpassing that high. Ahead of the anticipated print, the 5-star analyst reiterated an Outperform (i.e., Buy) rating on Amazon shares along with a $225 price target, implying the stock will climb 21% higher over the one-year timeframe. (To watch Blackledge’s track record, click here)

Looking ahead to the results, Blackledge strikes a confident tone: “We like AMZN shares into 1Q earnings as we are ~1% above consensus 1Q24 revenue with growth driven by 3P sales, advertising and accelerating AWS growth.”

For the quarter, Blackledge is calling for revenue of $143.7 billion, amounting to a 12.8% year-over-year increase, slightly above the guide’s high end ($138 -$143.5 billion), and just edging consensus at $142.6 billion. Segment wise, due to strong Prime purchaser growth in a number of big verticals (Apparel, Consumable, Beauty, etc) per Cowen’s proprietary survey, and partly boosted by the “fastest delivery speeds in AMZN’s history,” Blackledge is bullish on the North America segment, expecting revenue to grow 12.6% compared to the same period a year ago. Additionally, as comps ease by 440bps, and supported by management’s statement during the Q4 call that customers are increasingly prioritizing driving new workloads to the cloud over cost optimizations, the analyst sees AWS growth accelerating to +15.3% year-over-year vs. +13.2% y/y in Q4.

On operating income (OI), Blackledge anticipates a 160% y/y uptick to $12.6 billion, surpassing the high end of the guide ($8.0-$12.0 billion) and a notable 15% above the Street’s call for $10.9 billion. “Key drivers include higher gross profit driven by rising 3P, adv and AWS mix, as well as a $900MM benefit from the extension of the useful lives of servers,” Blackledge explained.

Looking ahead to Q2, driven by advertising, 3P retail services and AWS, Blackledge expects revenue of $151.3 billion, amounting to a 12.6% y/y increase and accelerating on the 10.8% growth seen in 2Q23. Consensus has $150.3 billion. Blackledge is calling for forecast Op Income (GAAP) of $13.7 billion, representing a 78% y/y uptick.

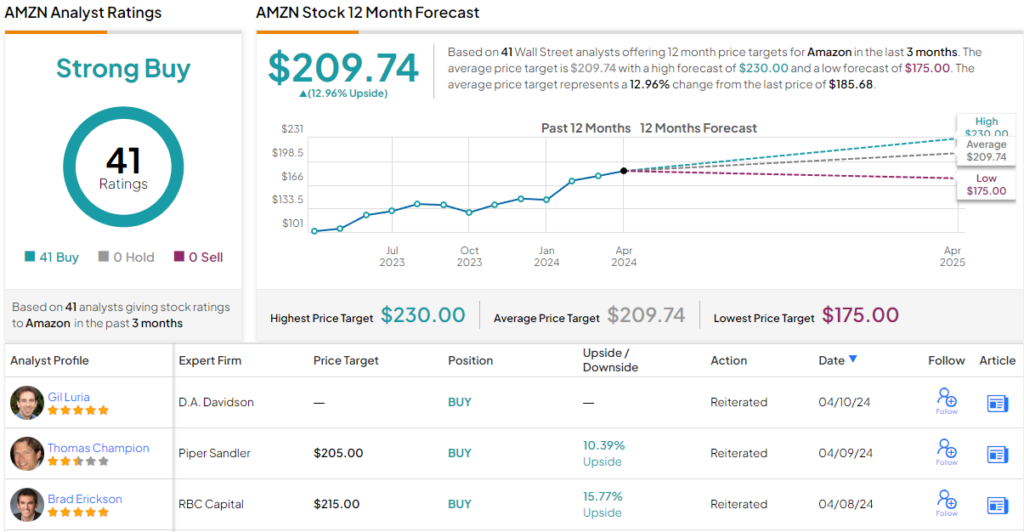

Blackledge’s bullish take gets the Street’s full support. All 41 analyst reviews on file are positive, naturally making the consensus view here a Strong Buy. At $209.74, the average target factors in 12-month returns of 13%. (See Amazon stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.