Barclays’ top analyst Raimo Lenschow maintained his “Hold” rating on CoreWeave (CRWV) stock, despite news of an expanded partnership with OpenAI. He also kept his price target unchanged at $140, implying 10.5% upside potential from current levels. CoreWeave and OpenAI signed a $6.5 billion deal, under which the former will provide cloud infrastructure to support OpenAI’s most advanced AI model training and inference workloads.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Lenschow’s Hold rating could stem from concerns about CoreWeave’s already stretched valuation. Year-to-date, CRWV stock has surged over 240%.

Lenschow is a five-star analyst on TipRanks, ranking #419 out of 10,050 analysts ranked. He boasts a 61% success rate and an average return per rating of 12%.

The New Deal Will Boost CoreWeave’s Growth

Following CoreWeave’s deepened partnership with the ChatGPT maker, their total contract value now stands at $22.4 billion. Lenschow pointed out that the new deal is about the same size as the $4 billion agreement OpenAI made with CoreWeave in May 2025, which covered one site through 2029. He suggested that this earlier deal could be a good guide for understanding the structure of the latest agreement, since there is limited information about the new deal.

He added that CoreWeave is set to bring several new data centers online in 2026 through partnerships with Core Scientific (CORZ), Galaxy Digital (GLXY), and Applied Digital (APLD), which are expected to support OpenAI and other incremental workloads.

Demand for Compute Capacity Is Accelerating

Lenschow believes demand for compute capacity is accelerating, which should drive sustained RPO (Remaining Performance Obligation) growth for CoreWeave over the coming years. Furthermore, he highlighted that CoreWeave and other data center companies have been announcing a slew of agreements aimed at boosting their compute and infrastructure offerings.

CoreWeave recently amended its Master Services Agreement (MSA) with semiconductor giant Nvidia (NVDA). Additionally, Nvidia announced a $100 billion deal with OpenAI, and software giant Oracle (ORCL) signed a $300 billion cloud deal with OpenAI.

Analysts project CoreWeave’s 2025 revenue to grow 174% to over $5 billion, though the company is still expected to post a net loss as it continues investing heavily in growth and infrastructure.

Is CRWV Stock a Buy, Hold, or Sell?

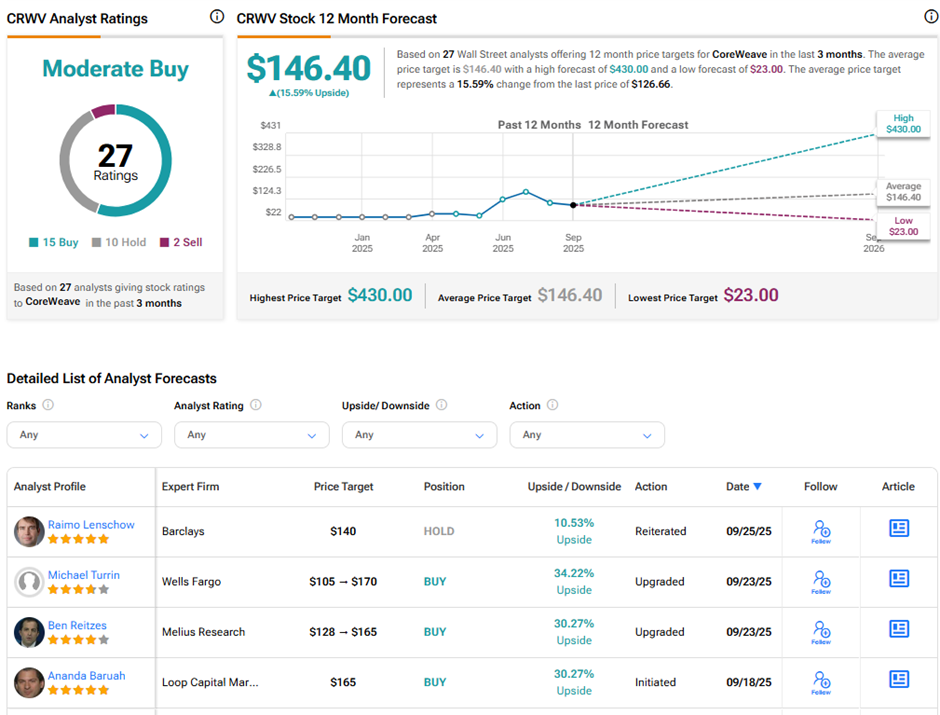

On TipRanks, CRWV stock has a Moderate Buy consensus rating based on 15 Buys, 10 Holds, and two Sell ratings. The average CoreWeave price target of $146.40 implies 15.6% upside potential from current levels.