Hims & Hers Health (HIMS) stock is in the spotlight as four-star-rated analyst Allen Lutz from Bank of America Securities reiterated his Sell rating, despite the company’s recent rollout of new women’s health products. The move comes amid strong market interest in its expanded offerings, highlighting a contrast between analyst caution and investor enthusiasm.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, Hims & Hers Health provides accessible healthcare products and services, including prescription medications, wellness products, and online medical consultations.

Women’s Health Launch Sparks Excitement for HIMS Stock

HIMS stock jumped 16.18% on Wednesday after the company rolled out a new women’s health specialty, providing treatment plans for women going through perimenopause and menopause. Starting immediately, women can connect with a provider on the platform to get personalized care.

Notably, the company’s women’s health division already serves over 500,000 subscribers and is projected to exceed $1 billion in annual revenue by 2026.

HIMS stock reversed some of its gains from yesterday and is down by 1.4% in pre-market hours on Thursday.

BofA Keeps Sell Rating on HIMS

Investor sentiment around HIMS stock was weakened by Lutz’s Sell rating. He also maintained his price target of $28, implying a downside of over 55% from current levels. Lutz noted that the company’s new women’s health specialty offers prescription hormone replacement therapies, including estradiol and progesterone, to help address symptoms like hot flashes and sleep disturbances.

Additionally, he highlighted that the launch broadens the brand’s presence in a multi-billion-dollar market and supports revenue diversification amid pressure on the men’s segment. Overall, Lutz expects the newly launched treatments to deliver modest financial contributions in Q4, with growth ramping up into 2026.

Despite this promising expansion, Lutz remains concerned about the company’s near-term performance. Earlier this month, Lutz reiterated his Sell rating on Hims & Hers Health, citing struggles to meet Q3 sales expectations. He stated that weaker order growth raises concerns for upcoming quarters, while rising customer acquisition costs, increased competition, and recent FDA reforms could further pressure margins.

Hims & Hers is set to release its Q3 2025 earnings report on November 3.

Is HIMS Stock a Good Buy?

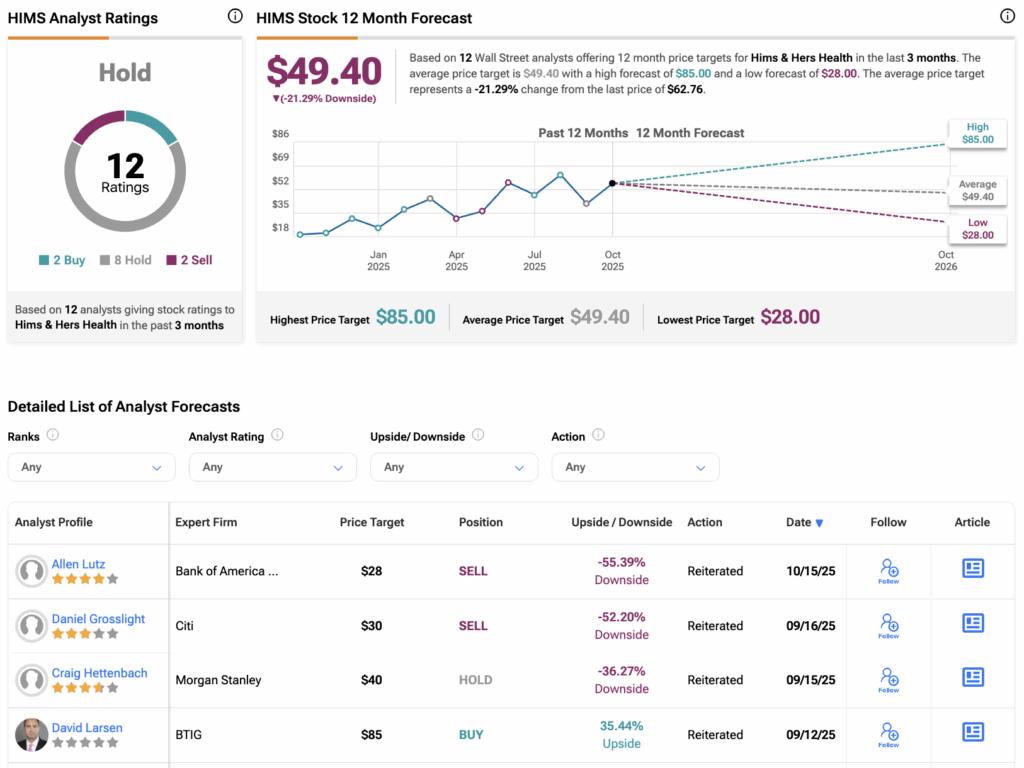

Overall, Wall Street analysts have a Hold consensus rating on HIMS stock based on two Buys, eight Holds, and two Sells assigned in the last three months. The average HIMS stock price target of $49.40 implies a downside of 21.3% from the current trading level.