After a strong 2023, Intel (NASDAQ:INTC) has not been great so far. Off the pace in the AI chip game, while the recent restructuring highlighted the ongoing losses of its foundry business, shares of the semi giant have retreated by 29% year-to-date.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With the company readying to report Q1 earnings next Thursday (April 25), can the print help turn sentiment around?

While not taking a wholly bearish stance, Susquehanna’s Christopher Rolland, an analyst ranked in 17th spot amongst the thousands of Wall Street stock pros, doesn’t seem especially committed to that idea.

“We expect results and guidance to be generally in-line to slightly weaker on OK Client shipments, but Server weakness in front of yet-to-launch new products in 2H. Additionally, we note headwinds from inventory corrections for Altera, NEX, and MBLY,” Rolland noted.

For Client, as Q1 notebook ODM builds and PC sell-through both came in above previous expectations and with ODM build data getting stronger towards the end of the quarter, Rolland says his PC checks were “generally positive.” The analyst also notes that Susquehanna’s 1Q24 PC-SIGnals data implied Intel saw both laptop and desktop CPU share gains, with the Raptor Lake refresh driving laptop share to its highest level since 1Q22. “However,” the 5-star analyst goes on to say, “we note Meteor Lake only represented ~0.2% of Intel laptop mix after launching in December, consistent with our checks that suggested MTL is taking longer to ramp, although perhaps to benefit in 2H (along with Arrow/Lunar Lake?).”

On the DCAI side, according to Rolland’s checks, January and February appeared weak but saw an improvement in March, and that could be a boon for Q2. Moreover, Intel is preparing to introduce Sierra Forest (its Xeon server processors) in Q2, to be followed by Granite Rapids, although the company has acknowledged that its DC product launches ramp at a slower pace compared to the Client side which is “a negative.” While Rolland is of the mind AI server GPU purchases have “crowded out CPU wallet share,” there are indications from some quarters that there might be a slight resurgence in “traditional server spend” in the latter half of the year.

“In short,” Rolland summed up, “we expect Intel to post a relatively in-line to modestly worse guide, but hope for strength from there in 2H.”

All in all, the analyst rates Intel shares a Neutral and slightly reduced his price target from $42 to $40. (To watch Rolland’s track record, click here)

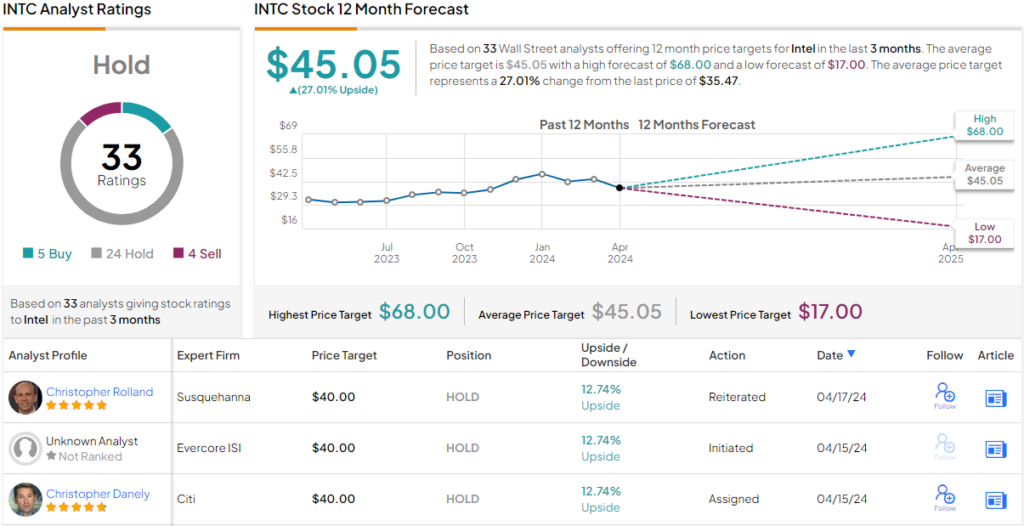

Wall Street backs Rolland’s caution here, as TipRanks analytics reveal INTC as a Hold. Based on 33 analysts tracked by TipRanks in the last 3 months, 24 rate the stock a Hold, 5 recommend a Buy, while 4 issue a Sell. However, the 12-month average price target stands at $45.05, marking a 27% upside from where the stock is currently trading. (See Intel stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.