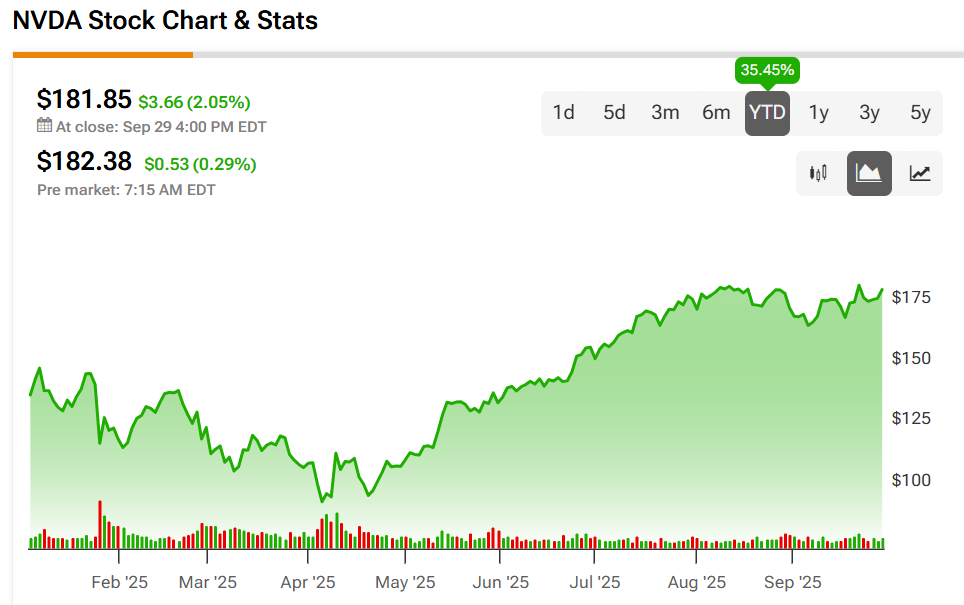

Nvidia (NVDA) is gaining support from Wall Street as it expands its AI push. Citi kept its buy rating on the stock and lifted its price target to $210 from $200. The new target suggests about 15.5% upside from the most recent close of $181.85.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Citi’s top analyst, Atif Malik, said the launch of the new Rubin CPX graphics unit gave reason for more confidence. He also pointed to stronger AI infrastructure spending ahead. As a result, Citi now models sales of $54 billion for the October quarter and $62 billion for the January quarter. It also raised its estimates for calendar 2026 and 2027 by 1% and 10%.

In the meantime, NVDA shares climbed 2.05% on Monday, closing at $181.85.

Product Updates and Key Plans

Earlier this month, Nvidia unveiled the Rubin CPX, a high-end processor built to handle generative video at high speed. The product is planned for release in late 2026. Malik noted the device improves Nvidia’s roadmap and strengthens its lead in AI workloads.

In addition, Nvidia recently said it would invest up to $100 billion in OpenAI. The plan is to help fund large data centers that will serve the rising demand for AI services. Citi added that this deal will not change Nvidia’s ongoing plans with ARM (ARM), and that the company is also giving customers more options with x86 systems.

Is Nvidia Stock a Buy?

Across Wall Street, analysts remain bullish on the stock. Out of 38 ratings, there are 35 signaling a Buy. The average price target is $212.78, implying about 17.01% upside from the current level.